Tax Hotline: Different but Still the Same: Canadian Court invokes SAAR, disregards company’s separate legal existence

Posted by By nishithadmin at 22 March, at 12 : 57 PM Print

Warning: count(): Parameter must be an array or an object that implements Countable in /web/qlc/nishith.tv/htdocs/wp-content/themes/Video/single_blog.php on line 46

Warning: count(): Parameter must be an array or an object that implements Countable in /web/qlc/nishith.tv/htdocs/wp-content/themes/Video/single_blog.php on line 52

DIFFERENT BUT STILL THE SAME: CANADIAN COURT INVOKES SAAR, DISREGARDS COMPANY’S SEPARATE LEGAL EXISTENCE

- Tax Court holds that the one of the main reasons for a Taxpayer’s separate legal existence was to obtain a tax benefit

- Invokes SAAR to disregard separate legal existence to deny small company deduction

- Finds that insufficient evidence was presented to establish that other commercial / non-tax reasons underpinned the Taxpayer’s separate legal existence.

In a recent ruling1, the Tax Court of Canada (“Court”) ruled that one of the main purposes for the separate legal existence of a company (“Taxpayer”) was to obtain a reduction of tax payable in Canada. As a consequence, the Court denied the company the small company deduction available under Section 125 of the Canadian Income Tax Act (“CITA”).

BACKGROUND

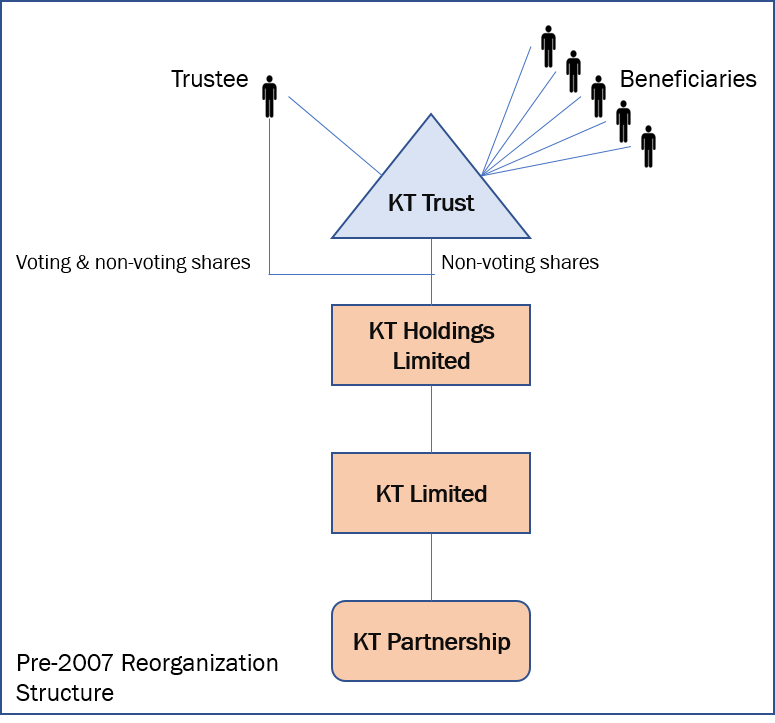

Kal Tire is a global tire business founded by the late Tom Foord and carried on through a number of companies and their subsidiaries, all of which were ultimately owned by the Kal Tire Partnership. Mr. Foord’s interest in the Kal Tire Partnership was held by a company known as Kal Tire Ltd. (“KT Limited”) which was a wholly owned subsidiary of Kal Tire Holdings Limited (“KT Holdings”). Mr. Foord controlled KT Holdings through a class of voting shares, while the common shares of KT Holdings were held by a trust known as the Kal Management Trust (“KT Trust”). Mr. Foord was the trustee of the KT Trust and his five children were the beneficiaries This structure is depicted in the diagram below.

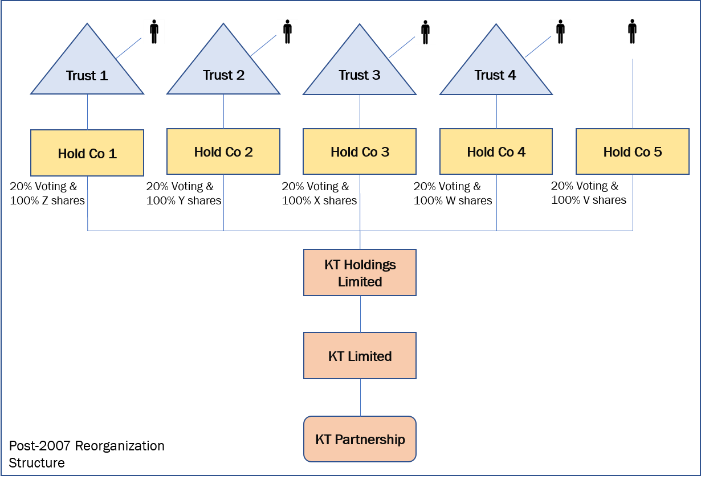

In 2007, KT Holdings underwent a significant reorganization (the “2007 Reorganization”) pursuant to which the voting and non-voting shares of KT Holdings held by Mr. Foord and the KT Trust were transferred to holding companies incorporated by each of the Foord children (“Hold Cos”) and the interests of four of the Foord children in their Hold Cos were frozen in favour of four new family trusts. The post-2007 Reorganization structure is depicted in the diagram below.

The Canadian Tax Authorities (“Revenue”) argued that the 2007 Reorganization was designed in a way that allowed the Hold Cos to claim the small business deduction in respect of active business income that flowed to them from KT Holdings. Under section 125 of the CITA, Canadian-controlled private corporations are taxed at a lower rate on their first CAD 500,000 of active business income.

Under section 125 of the CITA, associated corporations are generally required to share one CAD 500,000 business limit among themselves. Further, subsection 125(5.1) eliminates the small business deduction if a corporation (or its associated corporations) becomes too large. It does so by reducing a corporation’s deduction to the extent that the corporation and its associated corporations have significant taxable capital2 employed in Canada.3 From 2001 to 2007, subsection 125(5.1) prevented KT Holdings and KT Limited from claiming the small business deduction.

However, when two corporations are associated with each other by virtue of their common association with a third company (in this case KT Holdings), the third company may make an election under subsection 256(2) of the CITA to not be associated with either of the other companies for the purpose of section 125. Following the 2017 Reorganization, KT Holdings made that election and as a result each Hold Co was able to maintain its own $500,000 business limit.4The 2007 Reorganization also involved a series of dividend and loan transactions. KT Limited would withdraw funds from the KT Partnership and use those funds to pay dividends to KT Holdings. KT Holdings would then use those funds to pay dividends to each Hold Co. The Hold Cos would then take the funds received and lend them back to KT Holdings, which lent them back to KT Limited, which recontributed the funds to the partnership. The amount of dividends paid and the interest rate on the loans were determined to ensure that, once all of the transactions had occurred, each Hold Co would earn CAD 500,000 of interest income each year.

The Canadian tax authorities (“Revenue”) denied the Taxpayer the small business deduction by relying on the specific anti-avoidance rule (“SAAR”) in subsection 256(2.1) of the CITA which provides that if one of the main reasons for the separate existence of two or more corporations may reasonably be considered to be the reduction of taxes that would be otherwise payable, the two corporations shall be deemed to be associated with each other.

The Taxpayer appealed to Court. Before the Court, the Revenue also made an additional argument that the General Anti-Avoidance Rule (“GAAR”) would also be applicable.

ISSUE

Whether one of the main reasons for the separate existence of the Taxpayer was to reduce the amount of tax that was otherwise payable under the CITA?

RULING

The Court ruled in favour of the Revenue. The Court’s analysis involved a two-step process (a) establishing that the separate existence resulted in a reduction in tax otherwise payable, and (b) establishing that the tax reduction was one of the main reasons for the Taxpayer’s separate existence.

(1) Tax Reduction.

The Court found that as a result of the 2007 Reorganization and the election by KT Holdings under section 2567(2), the Taxpayer had active business income of CAD 500,000 and a corresponding small business limit of CAD 500,000 in each of the years in question, which allowed the Taxpayer to claim a small business deduction of approximately $84,000 each year.

The Court found that If the Taxpayer did not exist, this tax reduction would not have occurred and instead the interest income earned by the Taxpayer would have been earned by the trusts or their beneficiaries, neither of whom was entitled to claim the small business deduction. Thus, the Court found that the first condition of section 256(2.1) i.e., a reduction of taxes arising out of separate existence, had been met.

(2) Main Purpose

Under section 256(2.1), the burden lies on the taxpayer to prove that reducing tax was not one of the main reasons for its separate existence. The Court held that the Taxpayer had failed to discharge its burden for the following reasons:

- there was no direct evidence of the main reasons for the Taxpayer’s separate existence;

- there was no direct evidence of the main reasons for the separate existence of the other Hold Cos;

- the indirect evidence of the main reasons for the separate existence of the Hold Cos was not reliable;

- the documentary evidence indicates that tax reduction was an important reason for the use of the Hold Cos; and

- most of the alternative explanations offered for the separate existence of the Hold Cos were not convincing.

While the Taxpayer submitted that there were four potential reasons for the separate existence of the Hold Cos i.e., estate planning for the Foord children, keeping ownership within the Foord family, corporate and partnership governance and investment planning, the Court rejected all except estate planning for the following reasons:

- Keeping Ownership within the Foord Family. The risk of ownership moving beyond the family existed with or without the Hold Cos. The reduction of that risk did not come from introducing the HoldCos but rather through carefully drafted shareholders’ agreements and carefully planned life insurance funded buyout arrangements.

- Corporate and Partnership Governance. While the Court accepted that the Foord family had very serious concerns about governance issues, it did not accept that these were solved by creation of the Hold Cos.

- Investment Planning. While the Court accepted that holding companies are commonly used to allow individual shareholders to make personal, tax effective decisions about how they want to deal with dividends that they receive from an operating company, since the KT Partnership had a policy of not distributing profits and KT Holdings had a history of providing shareholders with a relatively modest income and an expressed goal of continuing that policy, the Court found it difficult to see how any of the Foord children would have benefitted from using holding companies for investment planning purposes.

ANALYSIS

One of the prerequisites for the application of India’s general anti-avoidance rule (“GAAR”) to an arrangement is that that the main purpose of the arrangement was to obtain a tax benefit. To that extent, the Canadian law is wider in its ambit as it provides that even if one of the main reasons was to obtain a tax benefit, GAAR would be applicable.

However, this ruling emphasizes the importance of parties to be able to demonstrate the commercial and non-tax reasons that underlie an arrangement, and to be able to corroborate these reasons with direct evidence.

It is currently common practice for taxpayers to commission structuring memoranda and step-plans from accountants and advisors. These documents usually outline the rationale for a restructuring, including the potential tax benefits. This way it is possible to justify the various reasons why a structuring was done. This ruling is a reminder that laying undue emphasis on the tax benefits of a restructuring may only serve to provide tax authorities with a foothold to challenge a structure.

Parties (and their advisors) implementing a structure or undertaking a restructuring should bear these aspects in mind. Official records, such agenda, notices and minutes should emphasize non-tax and commercial reasons. Other records, such as email correspondence, text messages, advisory memoranda and structure notes should support these reasons.

1 Jencal Holdings Ltd. v. Her Majesty the Queen, 2019 TCC 16

2 A corporation’s taxable capital is, in general, the total of its shareholder’s equity, surpluses and reserves, and loans and advances to the corporation, less certain types of investments in other corporations.

3 The grind completely eliminates the business limit once the taxable capital employed in Canada exceeds CAD 15,000,000.

4 Under the CITA, only active business income qualifies for the small business deduction. Normally, passive interest income earned by a corporation is taxed as income from property rather than as active business income. However, if a Canadian‑controlled private corporation pays interest to an associated corporation, then that interest is deemed to be active business income of the associated corporation. The election that KT Holdings made under subsection 256(2) not to be associated with each Hold Co only applied for the purposes of section 125.

Legal500 Asia-Pacific 2019: Tier 1 for Dispute Resolution, International Tax, Investment Funds, Labour & Employment, TMT and Corporate M&A

Chambers and Partners Asia Pacific 2019: Band 1 for Labour & Employment, Lifesciences, Tax and TMT

AsiaLaw 2019: Ranked ‘Outstanding’ for Technology, Labour & Employment, Private Equity, Regulatory and Tax

IFLR 1000 Asia Pacific 2019: Tier 1 for TMT and Private Equity

RSG-Financial Times: India’s Most Innovative Law Firm (2014, 2015 & 2017)

RSG-FT Awards (London) 2016: Asia Pacific’s Most Innovative Law Firm

Merger Market 2018: Fastest growing M&A practice

Benchmark Litigation Asia Pacific 2018: Tier 1 for Tax

IDEX: Tier 1 for Dispute Resolution

Asian Mena Counsel’s In-House Community Firms survey 2018- NDA voted as the only firm from India to excel in the Life Sciences sector

The Most Innovative Law Firm in Asia-Pacific

DISCLAIMER

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.