Tax Hotline: Mauritius route emerges unscathed: AAR upholds relief under the Mauritius treaty

Posted by By nishithadmin at 4 February, at 22 : 42 PM Print

Warning: count(): Parameter must be an array or an object that implements Countable in /web/qlc/nishith.tv/htdocs/wp-content/themes/Video/single_blog.php on line 46

Warning: count(): Parameter must be an array or an object that implements Countable in /web/qlc/nishith.tv/htdocs/wp-content/themes/Video/single_blog.php on line 52

Mauritius route emerges unscathed: AAR upholds relief under the Mauritius treaty

- AAR re-iterates the position that capital gains earned by a Mauritius company from transfer of shares of an Indian company are not chargeable to tax in India in the absence of a permanent establishment in India.

- The Mauritius route cannot be treated as a device to avoid tax if the Mauritius entity has been holding Indian securities as an investment and for a long period of time.

- Transfer pricing provisions do not apply if no income is chargeable to tax in India.

- Requirement to file tax returns does not arise if no income is chargeable to tax in India, irrespective of whether relief under tax treaty is availed.

Recently, the Authority for Advance Rulings (“AAR”) in the case of Dow AgroSciences Agricultural Products Limited,1 re-affirmed that capital gains earned by a Mauritius company from transfer of shares of an Indian company shall not be taxable in India, unless the Mauritian company has a Permanent Establishment (“PE”) in India. Further, the AAR held that an investment through a Mauritian subsidiary which has been held for long period of time cannot be considered to be a device for tax avoidance. The AAR also re-iterated that provisions dealing with withholding tax, transfer pricing and filing tax returns are not attracted when no income is chargeable to tax in India.

Facts

Dow AgroSciences Agricultural Products Limited (“DAS Mauritius”) is a company incorporated in Mauritius. DAS Mauritius is a subsidiary of Dow AgroSciences LLC (“DAS US”) and is a part of the Dow group (“Group”), which is a multi-national group with presence across the globe.

DAS Mauritius set up a subsidiary in India Dow AgroSciences India Private Limited (“DAS India”). DAS Mauritius made investments in DAS India between the years 1994 to 2005 and holds around 99.99% of the shares of DAS India.

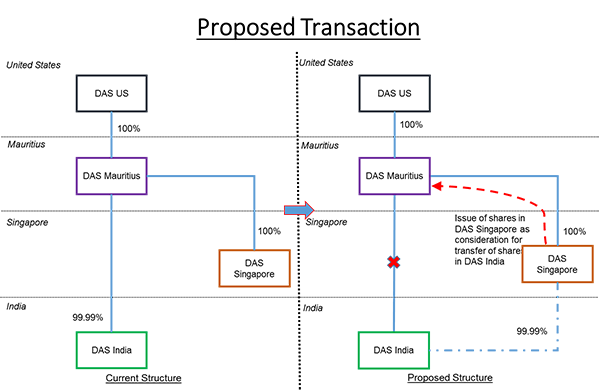

The geography-wise regional divisions of the Group were re-defined in 2010 to focus on customer service, strong compliance culture, commitment to health, safety and the environment, and commitment to developing people that deliver strong results for the Group. The Group was earlier divided into 5 areas on the basis of geography with India coming under the Dow India, Middle East and Africa group (earlier referred to as the Dow IMEA group). In 2010, the IMEA group was dismantled and the entities were included under other regional divisions, with India being included in the Asia Pacific group. Consequently, it has been proposed that the shares in DAS India be transferred by DAS Mauritius to a subsidiary of DAS Mauritius in Singapore, (“DAS Singapore”) and in lieu of such transfer, DAS Singapore shall issue shares to DAS Mauritius (“Proposed Transaction”).

DAS Mauritius filed an application before the AAR on taxability of the Proposed Transaction in India as per the provisions of the Income Tax Act, 1961 (“ITA”) read with the India Mauritius Double Taxation Avoidance Agreement (“Mauritius Treaty”) and applicability of the provisions relating to MAT, transfer pricing and filing of tax returns.

As per the Mauritius Treaty, any capital gains accruing to a Mauritian resident from the transfer of shares of an Indian company are not taxable in India, unless the Mauritian resident has a PE in India.

Ruling

The AAR ruled that the Proposed Transaction was not taxable in India as per the Mauritius Treaty and hence, there was no obligation on DAS Mauritius to file tax returns in India.

Proposed Transaction not a Scheme to Avoid Taxes: The revenue raised a contention that DAS Mauritius was a shell company and shares in DAS India were acquired through DAS Mauritius merely to avoid paying tax on capital gains in India. Therefore, it was argued that the capital gains arising from the Proposed Transaction should be treated as capital gains earned by DAS US and capital gains relief under the Mauritius Treaty is not available. The AAR referred to landmark precedents2 and held that an investment in India through a wholly owned company in Mauritius could not be considered as a device for tax evasion merely on the basis that the Mauritius entity was set up with an eye on the Mauritius Treaty. The AAR also noted that DAS Mauritius had begun investing into DAS India about 20 years ago (with the last tranche of investment made about 10 years ago) with prior approval from relevant regulatory authorities. Further, decisions relating to re-alignment of groups within the entity was only made after 5 years post the last tranche of investment. Hence, the AAR held that the Group could not be considered to have made investments through DAS Mauritius with an eye on selling in future and avoiding taxes on possible capital gains.

No PE of DAS Mauritius in India: As DAS Mauritius did not have any fixed base / agent in India, it was concluded by the AAR that DAS Mauritius did not have a PE in India.

The AAR held that factors such as the following are irrelevant in the determination of the existence of a PE of DAS Mauritius in India:

(a) issue of Employee Stock Options by DAS USA to the employees of DAS India;

(b) huge royalty payment and service charges paid by DAS India to Group entities;

(c) purchase of raw materials, intermediates and finished good from DAS USA;

(d) sale of products branded and marketed by DAS USA;

(e) overall control and guidance of DAS India’s operations by DAS USA.

Non-Applicability of MAT provisions: As the name suggests, MAT provisions prescribe a minimum alternate tax3 payable by companies in case the tax payable by them is below a certain threshold. There was ambiguity regarding the applicability of these provisions to foreign companies till a few months back when the matter was put to rest by the government. In light of the position taken by the government based on the recommendations of the A. P. Shah Committee4 read with the subsequent CBDT Press Release,5 and in light of the ruling of the Supreme Court in the case of Castleton Investment Ltd. v. Director of Income-tax (International Taxation-I), Mumbai,6 the AAR held that MAT does not apply to a foreign company if it was a resident of a country with which India has entered into a Double Taxation Avoidance Agreement and the foreign company does not have a PE in India. Consequently, the AAR held that MAT does not apply to DAS Mauritius in relation to gains earned from the Proposed Transaction.7

Non-Applicability of Transfer Pricing provisions: Transfer pricing provisions seek to assign an independent or arm’s length value to transactions that take place between associated entities so that income is not shifted to an associated enterprise in another jurisdiction with less onerous tax consequences. The AAR held that the transfer pricing provisions are not independent charging provisions and consequently, as capital gains resulting from the Proposed Transaction are not taxable in India, transfer pricing provisions should not apply.

No Obligation to File Tax Returns: Relying on earlier rulings in FactSet Research Systems8 and Vanenburg Group,9 the AAR held that the machinery provisions governing filing of tax returns are not applicable if there is no income chargeable to tax in India. While the AAR had given conflicting rulings in the past on this issue, the AAR relied on the rulings mentioned above as they were based on the binding judgment of the Federal Court in the case of Chatturam v. CIT.10

Analysis and Key Takeaways

This ruling is a welcome development, providing clarity to existing and potential foreign investors, particularly those looking at long-term investment as their primary objective (as against merely availing treaty relief on divestment). The ruling re-iterates the fundamentals of established principles and provides re-assurance in the context of (i) several doubts being raised on Mauritius structures, particularly, in light of ongoing discussions between the Indian and Mauritius government for amending the Mauritius Treaty and the General Anti-Avoidance Rules (“GAAR”) set to come into force from April 1, 2017; and (ii) the increasing focus globally against tax avoidance and on substance over form, especially with the ongoing Base Erosion and Profit Shifting (“BEPS”) project and other similar developments. This ruling also emphasizes on the importance of clearly recording commercial objectives while structuring / re-structuring investments.

Further, the AAR’s ruling in relation to the obligation to file tax returns and the applicability of transfer pricing provisions, will reduce compliance burden and costs significantly. However, as there are conflicting rulings on these points, ambiguity may continue till a position is taken by the Supreme Court, particularly, as a 2013 amendment to the income tax rules provides that tax returns are required to be filed to claim relief under tax treaties.

1 AAR No. 1123 of 2011. Order dated 11th January, 2016.

2 Union of India v. Azadi Bachao Andolan and Anr. [2003] 263 ITR 706 (SC); Vodafone International Holdings B.V. v. Union of India [2012] 341 ITR 1 (SC); E*Trade Mauritius Ltd., In re [2010] 324 ITR 1 (AAR)

3 18.5% of book profits from Assessment Year 2012-13.

4 Report on Applicability of Minimum Alternate Tax (MAT) on FIIs / FPIs for the period prior to 01.04.2015, dated 25th August 2015, prepared by A Committee on Direct Tax Matters, chaired by Justice Ajit Prakash Shah.

Available at http://finmin.nic.in/reports/ReportonApplicabilityofMinimumAlternateTax%20onFIIsFPIs.pdf

5 CBDT Press Release dated 24th September, 2015.

Available at http://www.incometaxindia.gov.in/Lists/Press%20Releases/Attachments/390/Press-Release-Applicability-of-Minimum-Alternate-Tax-24-09-2015.pdf

6 [2015] 62 taxmann.com 43 (SC).

7 Though the ruling has referred to the government position and precedents referred to above, it may be noted that they only relate to the period up to the financial year 2014-15. From April 2015 onwards, there is no ambiguity on this issue in light of amendments introduced in 2015

8 AAR No. 787 of 2008.

9 AAR No. 727 of 2006.

10 [1947] 15 ITR 302 (FC).

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.