Investment Funds: Monthly Digest: A brief insight into the new FPI Regulations and the Operating Guidelines thereto

Posted by By nishithadmin at 2 December, at 18 : 26 PM Print

Warning: count(): Parameter must be an array or an object that implements Countable in /web/qlc/nishith.tv/htdocs/wp-content/themes/Video/single_blog.php on line 46

Warning: count(): Parameter must be an array or an object that implements Countable in /web/qlc/nishith.tv/htdocs/wp-content/themes/Video/single_blog.php on line 52

A BRIEF INSIGHT INTO THE NEW FPI REGULATIONS AND THE OPERATING GUIDELINES THERETO

INTRODUCTION

The Securities and Exchange Board of India (“SEBI”) has introduced the SEBI (Foreign Portfolio Investors) Regulations, 2019 (“FPI Regulations 2019”)1, repealing the erstwhile SEBI (Foreign Portfolio Investors) Regulations, 20142. FPI Regulations 2019 are supplemented by the Operational Guidelines to facilitate implementation of the FPI Regulations 2019 (“Operational Guidelines”). The FPI Regulations 2019 read with the Operational Guidelines seem to have consolidated the feedback from industry on the different circulars that had been issued by SEBI under the FPI Regulations 2014. This hotline particularly deals with the key changes brought about by the FPI Regulations 2019 read with the Operational Guidelines.

ELIGIBILITY

a. Who can apply for an FPI license?

An FPI applicant is required to satisfy the following requisites:

i.RI/ NRI/ OCI

An FPI applicant should not be a resident Indian (“RI”) (this shall not apply if the applicant is incorporated or established in an International Financial Services Centre (“IFSC”)), a non-resident Indian (“NRI”) or an overseas citizen of India (“OCI”); however, RI/NRI/OCI individuals can be constituents of the said FPI applicant provided, the contribution of a single NRI or OCI or RI and aggregate contribution in the applicant is below 25% and 50%, respectively, of the total contribution in the corpus of the FPI applicant; However, an RI can be a constituent only if its contribution is made through the LRS subject to the applicant’s Indian exposure is less than 50%;

NOTE: The above two conditions do not apply in case of a non-investing FPI or if the FPI applicant proposes to invest or invests only in units of schemes floated by mutual funds in India.

- NRIs, OCIs and RIs should not be in control of the applicant, unless the applicant is an ‘offshore fund’ for which a ‘No Objection Certificate’ has been issued by SEBI in terms of the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996, or the applicant is controlled by an investment manager which is controlled and/or owned by NRI or OCI or RI; provided that such investment manager is appropriately regulated in its home jurisdiction and registered with SEBI as a non-investing FPI, or such investment manager is incorporated or setup under the Indian laws and appropriately registered with SEBI.

- An applicant or an existing FPI is required to comply with the above requisites: (a) within a period of 2 years from the date of registration or by December 31, 2020, whichever is later; and (b) within 90 days of temporary breach of the above investment limits (after December 31, 2020), failing which in each case of (a) and (b), the non-compliant FPI shall be prohibited from making any fresh purchase of securities and is required to liquidate its existing position in the Indian securities market within a further period of 180 days;

ii.The applicant (other than a Government or Government related investor who is a resident in the country as may be approved by the Government of India) is a resident of the country whose securities market regulator is a signatory to the International Organization of Securities Commission’s Multilateral Memorandum of Understanding or a signatory to the bilateral Memorandum of Understanding with SEBI; provided that this condition is not applicable to an applicant incorporated or established in IFSC.

iii.A bank (other than a central bank) is a resident of a country whose central bank is a member of Bank for International Settlements; provided that this condition is not applicable to an applicant incorporated or established in IFSC.

iv.The applicant or its underlying investors contributing 25% or more in the corpus of the applicant or identified on the basis of control, shall not be person(s) mentioned in the Sanctions List notified from time to time by the United Nations Security Council and should not be a resident in the country identified in the public statement of Financial Action Task Force as (a) a jurisdiction having a strategic Anti-Money Laundering or Combating the Financing of Terrorism deficiencies to which counter measures apply; or (b) a jurisdiction that has not made sufficient progress or has not committed to an action plan developed with the Financial Action Task Force, to address deficiencies;

v.The applicant is a fit and proper person based on the criteria specified in Schedule II of the SEBI (Intermediaries) Regulations, 2008;

vi.any other criteria specified by SEBI from time to time.

b. Categories and Re-categorization

i.Categories

An Applicant can apply in one of the two categories mentioned below:

(a) Category I FPI which shall include

- Government and Government related investors, as prescribed in the FPI Regulations 2019;

- Pension funds and university funds;

- Appropriately regulated entities such as insurance or reinsurance entities, banks, asset management companies, investment managers, investment advisors, portfolio managers, broker dealers and swap dealers;

NOTE: “appropriately regulated” entity means an entity which is regulated by the securities market regulator or the banking regulator of home jurisdiction or otherwise, in the same capacity in which it proposes to make investments in India3. An applicant incorporated or established in an IFSC shall be deemed to be appropriately regulated.

- Entities from the Financial Action Task Force (“FATF”) member countries which are (a) appropriately regulated funds; (b) unregulated funds whose investment manager is appropriately regulated and registered as a Category I FPI; Provided that the investment manager undertakes the responsibility of all the acts of commission or omission of such unregulated fund; and (c) university related endowments of such universities that have been in existence for more than five years;

- An entity (A) whose investment manager is from the FATF member country and such an investment manager is registered as a Category I FPI; or (B) which is at least 75% owned, directly or indirectly by another entity, eligible under (ii), (iii) and (iv) of (a) above, and such an eligible entity is from a FATF member country; Provided that such an investment manager or eligible entity undertakes the responsibility of all the acts of commission or omission of the applicants seeking registration under this requirement.

(b) “Category II foreign portfolio investor” shall include all the investors not eligible under Category I foreign portfolio investors such as –

- appropriately regulated funds not eligible as Category-I foreign portfolio investor;

- endowments and foundations;

- charitable organizations;

- corporate bodies;

- family offices;

- Individuals;

- appropriately regulated entities investing on behalf of their client, as per conditions specified by SEBI from time to time;

- Unregulated funds in the form of limited partnership and trusts.

Analysis:

The FPI Regulations 2019 have done away with the erstwhile three categories and clubbed them into two categories. The key highlight however is the categorization of the funds based on their existence in a FATF member country jurisdiction/s.

To illustrate:

Situation 1:

If an appropriately regulated fund and its appropriately regulated investment manager are situated in Mauritius or Cayman Islands, the fund is ineligible for registration as a Category I FPI.

Situation 2:

If an appropriately regulated fund is situated in Mauritius or Cayman Islands and its appropriately regulated investment manager is situated in Singapore, the fund is eligible to seek registration as a Category I FPI, provided the investment manager too is registered as Category I FPI.

Situation 3:

If an unregulated fund is situated in United States of America or Singapore and its appropriately regulated investment manager is situated in Mauritius, the fund is still eligible to seek registration as a Category I FPI, provided the investment manager too is registered as Category I FPI.

The advantages of being registered as a Category I FPI as opposed to Category II are: (a) eligibility to issue ODIs (defined below); (b) ease of compliance of certain know your client (“KYC”) norms as compared to Category II FPIs; and (c) enhanced position limits in case of stock and currency derivatives. In this case, the Operating Guidelines have also distinguished between Category II FPIs that are individuals, family offices and corporate bodies and other Category II FPIs including funds and other pooling vehicles.

ii.Re-categorization of FPIs

Category I FPIs and category III FPIs registered under the erstwhile regulations are deemed to be recategorized as Category I FPIs and Category II FPIs, respectively under the FPI Regulations, 2019. Category II FPIs registered under the erstwhile regulations shall be recategorized as either Category I FPI or Category II FPI under the FPI Regulations 2019, depending on their satisfaction of the eligibility requirements as described above.

However, for any “eligible entity” registered as category III FPI under the erstwhile regulations, there is no deemed re-categorization to a Category I FPI under the FPI Regulations 2019.

iii.Broad-based Criteria

Under the erstwhile regulations, certain funds (other than university funds, pension funds etc.) whether appropriately regulated or unregulated, required to satisfy the broad-based criteria, for seeking registration as a Category II FPI. Broad-based funds were defined as funds established or incorporated outside India having at least 20 investors with no investor holding more than 49 percent of the shares or units of the fund on a look through basis.

However, under the FPI Regulations 2019, the requirement for funds to achieve the broad-based status has been done away with.

Analysis:

Several funds have struggled to either ‘achieve’ or ‘maintain’ the broad based criteria requirement. However, today all that should matter is the source of funds and the investor KYC. With certain investors (like those that are from FATF jurisdictions or are appropriately regulated), SEBI and the other authorities will find it easier to access the KYC of such investors and hence they are tiered as Category I. Doing away with the broad-based criteria requirement would in effect mean that a fund with even 1 investor holding shares/units, subject however to the fund satisfying the other requirements pertaining to eligibility, should also be able to apply for registration as a Category I FPI.

c. Opaque Structures

Under the erstwhile regulations, opaque structures or structures with segregated portfolio or like structures where determination of the ultimate beneficiary owners is not accessible or where the beneficial owners are ring fenced with each other, were not eligible for registration as FPI unless they satisfied certain conditions. However, under the FPI Regulations 2019, sub-funds or separate classes of shares or equivalent structures (including Protected Cell Companies to that extent) with segregated portfolio for such sub-funds or separate classes of shares or equivalent structure can each seek registration as FPI. However, they are required to provide beneficial owner (“BO”) declaration for each existing or additional fund/sub-fund/share class/equivalent structure that invests in India.

d. Appropriately regulated entities investing on behalf of their clients

The FPI Regulations 2019 further enhance the portfolio management models where appropriately regulated entities such as banks, merchant banks, asset management companies, investment managers, investment advisors, portfolio managers, insurance & reinsurance entities, broker dealers and swap dealers can undertake investments on behalf of their clients by seeking registration as a Category II FPI (in addition to the Category I FPI registration for their proprietary investments). However, such clients should only be individuals and family offices dealing on their own behalf and eligible for registration as an FPI themselves. However, it is to be noted that investments made by the client through such appropriately regulated entity will be clubbed with the investments made by such client, either directly as an FPI and/or through its investor group4, if the client’s participation through the above referenced appropriately regulated FPI entity is more than 50%.

Analysis

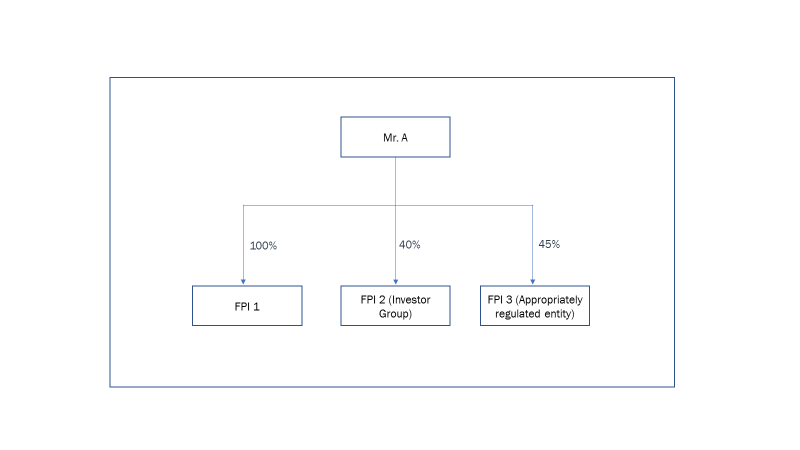

The below pictorial references are indicative of when the investments by such clients will be clubbed.

Situation 1 – Clubbing would take place

Situation 2 – No Clubbing

MULTIPLE INVESTMENT MANAGERS (“MIM”)

The FPI Regulations 2019 clarify that where an entity engages MIMs for managing its investments as separate allocations/ portfolios, such applicants can seek separate FPI registrations specific to each manager and appoint different DDPs for each such registration. Such FPIs registered under MIM structure shall have the same PAN.

Further, such entities are permitted to request for ‘Off Market’ transfer of assets between the different FPIs operating under MIM structure (with same PAN issued by Income Tax Department) to their DDPs and such requests can be processed by DDPs at their end.

INVESTMENT LIMITS

Individual Limits:

Under the FPI Regulations 2019 as well, the investment limit of a single FPI or an investor group in the equity shares of each company continues to be below 10% of the total paid-up equity capital on a fully diluted basis5 of the company.

The above-mentioned limit applies while investing through ODIs as well. For the purpose of clarity, two or more ODI subscribers having common ownership, directly or indirectly, of more than 50% or common control shall be considered together as a single ODI subscriber.

Further, investment as FPI and positions held as ODI subscriber will be clubbed together with reference to the above investment limits.

Exception:

The abovementioned 10% limit is not applicable to FPIs which are public retail funds6 provided: (a) they are appropriately regulated; or (b) where a majority is owned by appropriately regulated public retail fund on a look through basis; or (c) the investment manager of such a public retail fund is appropriately regulated.

Aggregate Limits:

In addition to the individual limits on the FPI or the investor group as explained above, the Central Government has vide Foreign Exchange Management (Non-debt Instruments) Rules, 2019 (“said Rules”) separately prescribed that the total holdings of all FPIs put together in an Indian company, including any other direct and indirect foreign investments in the Indian company permitted under the said Rules, shall not exceed 24% of paid-up equity capital on a fully diluted basis or paid up value of each series of debentures or preference shares or share warrants, .

Further, with effect from April 1, 2020, the said aggregate limit shall be the sectoral caps applicable to foreign investments in Indian companies as elaborated under Schedule I of the said Rules. The said aggregate limits can be decreased by March 31, 2020 or subsequently increased by the Company through a resolution and a special resolution by its Board of Directors and General Body, respectively in accordance with the said Rules.

Breach of Limits

In case of breach by an FPI (including its investor group) of the said 10% threshold, the FPI including each of the constituents of its investor group, will be required to divest the excess holding within five trading days from the date of settlement of the trades resulting in the breach, failing which the entire investment of such FPI including its investor group in such company shall be considered as an investment under the Foreign Direct Investment, and the FPI including its investor group shall not be entitled to make further investment in such portfolio company under the FPI Regulations 2019, i.e. on the floor of the exchange. Though the FPIs may elect to treat their investment as FDI, the sale of the securities by such FPI shall only be through the route they were acquired and appropriate reporting i.e. LEC reporting shall be made by the respective custodian.

Offshore Derivative Instruments

Under the erstwhile regulations, offshore derivative instruments (ODIs) was defined as any instrument, by whatever name called, which are issued overseas by a foreign portfolio investor against securities held by it that are listed or proposed to be listed on any recognised stock exchange in India, or unlisted debt securities or securitised debt instruments, as its underlying. This definition has now been revised to include a broader universe of securities. Under the FPI Regulations, 2019 ODI is defined as any instrument, by whatever name called, which is issued overseas by a foreign portfolio investor against securities held by it in India, as its underlying.

Under the erstwhile regulations, ODIs could be subscribed only by FPIs that are regulated by an appropriate foreign regulatory authority and after compliance with ‘know your client’ norms. However, unregulated broad-based funds classified as category II FPIs by virtue of their investment manager being appropriately regulated, and category III FPIs were not permitted to deal in ODIs. The FPI Regulations 2019 has done away with the requirement pertaining to “regulated by an appropriate foreign regulatory authority” and has instead permitted issuance of ODIs by Category I FPIs and issuance of ODIs to persons eligible for registration as Category I FPIs. This in effect means that an unregulated entity which is eligible to seek registration as a Category I FPI is permitted to hold an ODI.

Conditions for Issuance of ODIs

Issuance of ODIs referencing derivatives, by FPIs or hedging their ODIs with derivative positions on stock exchanges in India are not allowed unless -

- Derivative positions are taken on stock exchanges for ‘hedging of equity shares’7 held by the FPI in India, on a one to one basis; and/or

- hedging the ODIs by the FPI, referencing equity shares with derivative positions in Indian stock exchanges, subject to a position limit of 5% of market wide position limits for single stock derivatives.

In each case above, the FPI issuing ODI should take a separate ‘ODI issuing FPI’ registration under Category I.

An FPI issuing ODI, which hedges its ODI only by investing in securities (other than derivatives) held by it in India, cannot undertake proprietary derivative positions through the same FPI registration and must segregate its ODI and proprietary derivative investments through separate FPI registrations. An ODI issuing FPI cannot co-mingle its non-derivative proprietary investments and ODI hedge investments with its proprietary derivative investment or vice versa in same FPI registration.

In determining whether a derivative instrument issued is an ODI or not, the threshold for trades with non-proprietary indices (e.g. MSCI World or MSCI EM Asia) as underlying is to be taken as 20%, i.e. those trades for which the materiality of Indian underlying is less than 20% of the index would not be regarded as ODIs, even if such exposure is hedged onshore in India. However, trades with custom baskets as underlying if hedged onshore would always be regarded as ODIs regardless of percentage of Indian component that is hedged onshore in India.

Timelines to Compliance:

No fresh derivative position which is not in compliance with above requirements shall be allowed from the Operating Guidelines coming into force. FPIs have 90 days’ time from date of publication of the Operating Guidelines to comply with above requirements.

An ODI subscriber who became ineligible under the FPI Regulations 2019 may continue to hold their existing positions till December 31, 2020. No renewal/rollover of existing positions by such ODI subscribers shall be permitted and fresh issuance of ODIs shall be made only to eligible subscribers.

Off- Market Sale

FPIs are permitted to sell off-market unlisted, illiquid, suspended, and delisted shares in accordance with the pricing guidelines for such sale as per the Foreign Exchange Management Rules in this regard.

KNOW YOUR CLIENT REQUIREMENTS

The following table indicates the KYC documentation applicable for FPIs.

| Sr. No. | Document Type | KYC Documentation Details | Category I | Category II |

| 1. | Applicant Level | Constitutive Docs (MoA, COI, prospectus etc.) | Required | Required |

| 2. | Proof of Address* | Required | Required | |

| 3. | PAN | Required | Required | |

| 4. | Board Resolution2 | Not required | Required | |

| 5. | FATCA / CRS form | Required | Required | |

| 6. | Form/ KYC Form | Required | Required | |

| 7. | Authorised Signatories | List of Signatures** | Required | Required |

| 8. | Ultimate Beneficial Owner (UBO) | List of UBO including the details of Intermediate BO*** | Required | Required |

| 9. | Proof of Identity | Not Required | Required | |

| *Power of Attorney having address provided to Custodian is accepted as address proof.

** Power of Attorney granted to Global custodian/ local custodian is accepted in lieu of Board Resolution (BR). BR and the authorized signatory list (ASL) is not required if SWIFT is used as a medium of instruction. *** UBO is not required for Government and Government related entities. |

||||

Government and Government related investors such as central banks, sovereign wealth funds, international or multilateral organizations or agencies including entities controlled or at least 75% directly or indirectly owned by such Government and Government related investor(s) registered as Category I FPIs are exempt from providing BO details (“exempted entities”). Further, while applying the materiality threshold to identify BO on a look through basis in respect of FPIs other than exempted entities if an intermediate shareholder/ owner entity is eligible for registration as Category I FPI as an exempted entity (as defined above), there is no need for further identification and verification of beneficial owner of such intermediate shareholder/ owner entity.

High Risk Jurisdiction

While dealing with clients in high risk countries where the existence/effectiveness of money laundering control is suspect, intermediaries (including DDPs) apart from being guided by the Financial Action Task Force (FATF) statements that identify countries that do not or insufficiently apply the FATF Recommendations, published by the FATF on its website (www.fatf-gafi.org), are also required to independently access and consider other publicly available information. DDPs are required to cautiously verify the KYC of the investors coming from high-risk jurisdictions i.e. countries where generally the existence / effectiveness of money laundering controls is suspect, where there is unusual banking secrecy, countries active in narcotics production, countries where corruption (as per Transparency International Corruption Perception Index) is highly prevalent, countries against which government sanctions are applied, countries reputed to be any of the following – Havens/ sponsors of international terrorism, offshore financial centers, tax havens, countries where fraud is highly prevalent.8

For a Category I FPI (other than an exempted entity (as defined above)) coming from a high-risk jurisdiction: (a) the KYC documentation equivalent to Category II FPI shall be applicable; and (b) as identified by the intermediary, a lower materiality threshold of 10% for identification of BO shall be applicable.

Analysis

Therefore, we understand that apart from the list of countries identified by the FATF as “high-risk countries”, the DDPs also maintain a list of countries which they consider “high risk countries”. In other words, a country which is not already recognized as a “high-risk country” by the FATF on its website may be recognized as a “high-risk country” by DDP “A”, whereas DDP “B” may not recognize such country as being a “high-risk country” and accordingly, the relevant KYC norms shall be required to be followed.

CONCLUSION

All in all, the FPI Regulations 2019 read with the Operating Guidelines seek to simplify processes for FPIs including compliance requirements by such FPIs. Doing away with the broad-basing criteria and prohibition on opaque structures is a welcome move. The simplification of categorization of FPIs should encourage newer entrants in foreign portfolio investments in India. For existing FPIs, while there is tightening of norms around the ODI framework, from a stability of legal environment perspective, the FPI Regulations and the Operating Guidelines should be considered as a stable framework from the medium-term.

1 No. SEBI/LAD-NRO/GN/2019/36

2 Regulation 45(1) of the FPI Regulations 2019.

3 Regulation 2(1)(b) of the FPI Regulations, 2019.

4 Regulation 22(3) of the FPI Regulations defines investor group as multiple entities registered as FPIs and directly or indirectly, having common ownership of more than 50% or common control, shall be treated as part of the same investor group and the investment limits of all such entities shall be clubbed at the investment limit as applicable to a single FPI.

5 fully diluted basis’ means the total number of shares that would be outstanding if all possible sources of conversion are exercised.

6 Public retail funds mean: (i) mutual funds or unit trusts which are open for subscription to retail investors and which do not have specific investor type requirements like accredited investors; (ii) insurance companies where segregated portfolio with one to one correlation with a single investor is not maintained; and (iii)pension funds.

7 The term “hedging of equity shares” means taking a one-to-one position in only those derivatives, which have the same underlying as the equity share held by the FPI in India.

8 SEBI/ HO/ MIRSD/ DOS3/ CIR/ P/ 2018/ 104

IFLR1000: Tier 1 for Private Equity and Project Development: Telecommunications Networks.

2020, 2019, 2018, 2017, 2014

AsiaLaw Asia-Pacific Guide 2020: Ranked ‘Outstanding’ for TMT, Labour & Employment, Private Equity, Regulatory and Tax

FT Innovative Lawyers Asia Pacific 2019 Awards: NDA ranked 2nd in the Most Innovative Law Firm category (Asia-Pacific Headquartered)

RSG-Financial Times: India’s Most Innovative Law Firm

2019, 2017, 2016, 2015, 2014

Chambers and Partners Asia Pacific: Band 1 for Employment, Lifesciences, Tax and TMT

2019, 2018, 2017, 2016, 2015

Benchmark Litigation Asia-Pacific: Tier 1 for Government & Regulatory and Tax

2019, 2018

Legal500: Tier 1 for Dispute, Tax, Investment Funds, Labour & Employment, TMT and Corporate M&A

2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012

Who’s Who Legal 2019:

Nishith Desai, Corporate Tax and Private Funds – Thought Leader

Vikram Shroff, HR and Employment Law- Global Thought Leader

Vaibhav Parikh, Data Practices – Thought Leader (India)

Dr. Milind Antani, Pharma & Healthcare – only Indian Lawyer to be recognized for ‘Life sciences – Regulatory,’ for 5 years consecutively

Merger Market 2018:Fastest growing M&A Law Firm in India

Asia Mena Counsel’s In-House Community Firms Survey 2018:The only Indian Firm recognized for Life Sciences

IFLR: Indian Firm of the Year

2013, 2012, 2011, 2010

IDEX Legal Awards 2015: Nishith Desai Associates won the “M&A Deal of the year”, “Best Dispute Management lawyer”, “Best Use of Innovation and Technology in a law firm” and “Best Dispute Management Firm”

DISCLAIMER

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.