Regulatory Hotline: New Overseas Investment Regulations: Fillip in the right direction!

Posted by By nishithadmin at 21 September, at 11 : 28 AM Print

Warning: count(): Parameter must be an array or an object that implements Countable in /web/qlc/nishith.tv/htdocs/wp-content/themes/Video/single_blog.php on line 46

Warning: count(): Parameter must be an array or an object that implements Countable in /web/qlc/nishith.tv/htdocs/wp-content/themes/Video/single_blog.php on line 52

NEW OVERSEAS INVESTMENT REGULATIONS: FILLIP IN THE RIGHT DIRECTION!

I. HISTORY AND BACKGROUND

The Ministry of Finance (Department of Economic Affairs) and the Reserve Bank of India (“RBI”) respectively released the Foreign Exchange Management (Overseas Investment) Rules, 2022 (“OI Rules”)1 and the Foreign Exchange Management (Overseas Investment) Regulations, 2022 (“OI Regulations”)2. In addition to the introduction of the OI Rules and OI Regulations, the RBI has also issued the Foreign Exchange Management (Overseas Investment) Directions, 2022 (“OI Directions”)3 which are to be read in conjunction with OI rules and the OI Regulations. (collectively the OI Rules, OI Regulations and the OI Directions read as the “OI Framework”).

Pursuant to the release of the OI Framework, the RBI has also updated the master directions on Liberalized Remittance Scheme (“LRS”)4, which have been significantly amended to align it with the OI Framework. The LRS now categorizes (a) Overseas Direct Investments (“ODI”), and (b) Overseas Portfolio Investment (“OPI”), by an individual resident Indian as permissible capital account transactions, which are required to be carried out in accordance with the OI Framework.

Prior to the notification of the OI Framework, overseas direct investment in India was governed and regulated by the Foreign Exchange Management (Transfer or Issue of any Foreign Security) Regulations, 2004 (“ODI Regulations”) and Foreign Exchange Management (Acquisition and Transfer of Immovable Property Outside India) Regulations, 2015 (“Transfer of Property Regulations”, and collectively “Erstwhile Regime”).

The OI Rules deem any investment or financial commitment outside India made in accordance with the Foreign Exchange Management Act, 1999 (“FEMA”) or the rules or regulations made thereunder to have been made under the OI Rules and OI Regulations, thereby permitting grandfathering of overseas investments made as per the Erstwhile Regime.

The OI Rules and OI Regulations come after public comments and feedback on the Draft Foreign Exchange Management (Non-debt Instruments – Overseas Investment) Rules, 20215 and Draft – Foreign Exchange Management (Overseas Investment) Regulations, 20216 were taken about a year ago. The industry had since been awaiting the OI Rules and OI Regulations. It is imperative to note that while the OI Regulations have been issued by the RBI, the OI Rules have been issued by the Ministry of Finance of the Central Government, giving the Central Government the power to regulate – a power which was earlier wielded by RBI.

The new regime signifies the government’s attempt to simplify and liberalize the regulatory framework relating to overseas investments by persons resident in India and to promote ease of doing business. Considering the evolving business needs and increasingly integrated global market, several relaxations and changes have been introduced. Additionally, to ensure ease of doing business, the several types of investment related transactions that were under the approval route under the Erstwhile Regime have now been brought under the automatic route.

The OI Rules, inter alia have defined terms such as overseas portfolio investment, foreign entity, Indian entity, etc; it has provided specific rules for overseas investment in startups, and also permitted round tripping in certain cases, in addition to providing the much needed clarity on the manner and pricing of overseas investments. While all overseas investments in unlisted securities of a foreign entity have been covered under the umbrella of ODI, investments in listed securities of foreign entities may be categorised as either ODI or OPI, subject to the investment conditions.

In what comes as one of the most anticipated changes, the OI Rules have permitted overseas investment by resident Indians in International Financial Services Centre (“IFSC”), subject to certain conditions. This regulatory clarity is a welcome provision for the industry which was plagued by round-tripping concerns. On the other hand, OPI by individuals has been restricted to a few limited avenues, including by way of reinvestments.

In this hotline, we have discussed the OI Framework and its impact on the overseas investment from India, in detail.

II. KEY DEFINITIONS

Control: The OI Rules define control to mean (i) the right to appoint majority of the directors or (ii) right to control the management or policy decisions exercisable by a person or persons acting individually or in concert, including by virtue of their shareholding or management rights or shareholders agreement or voting agreements that entitle them to 10% or more voting rights or in any other manner in the entity.

The definition of ‘control’ in the OI Rules is similar to the definition of ‘control’ under the FEMA (Non-debt Instruments) Rules, 2019 and the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 However, it is important to note that this definition provides that even a 10% shareholding is sufficient to satisfy the control test, irrespective of whether an investor actually has the right to appoint majority of directors or participate in management / policy decisions.

Equity Capital: The introduction of a definition for equity capital is a welcome move as it provides clarity on the types of instruments in which overseas investment can be made. Equity capital has been defined to mean (i) equity shares or (ii) perpetual capital or (iii) instruments that are irredeemable or (iv) contribution to non-debt capital of a foreign entity in the nature of fully and compulsorily convertible instruments. . Thus, instruments such as optionally convertible debentures, or redeemable / optionally convertible preference shares will not fall within the meaning of Equity Capital.

Under the Erstwhile Regime, there were some AD-Banks who had taken the position that investment in foreign partnerships / limited liability companies (“LLCs”) was not possible as partnership interest did not come within the meaning of foreign securities. This issue has now been clarified and investment or contribution to perpetual capital of any foreign entity, including foreign limited partnerships / LLCs should also be considered as ‘equity capital’, Further, the scope of perpetual capital is also quite wide and may even cover contributions to the reserve capital of companies in certain jurisdictions like Germany, where such contribution to reserves is permitted.

Debt instruments: Debt instruments under the OI Rules have specifically been defined to mean:

- Government bonds;

- corporate bonds;

- all tranches of securitisation structure which are not equity tranche;

- borrowings by firms through loans; and

- depository receipts whose underlying securities are debt securities

From the language it seems that this is an exhaustive list, However, this leads to some ambiguity because while the intent of Debt instruments under the OI Rules and OI Directions is the same, optionally convertible, non-convertible and redeemable instruments (like OCDs, redeemable preference shares, and NCDs, which are typically considered debt instruments) have specifically been left out of the definition of Equity Capital under the OI Rules but have been included in the definition of “equity capital” under the OI Directions.

Financial Commitment: Financial commitment under the OI Rules means the aggregate amount of investment by a person resident in India by way of ODI or by way of debt (excluding OPI) in a foreign entity or entities in which ODI is made. Further, non-fund-based facilities (such as guarantees) extended by such a person resident in India to or on behalf of a foreign entity are also included within the meaning of financial commitment.

This definition is similar to the definition of financial commitment under the Erstwhile Regime. However, by virtue of the definitions of ODI and OPI, any non-controlling investment of less than 10% in a listed foreign entity will not be considered while computing financial commitment of an Indian entity.

Foreign Entity: A ‘Foreign Entity’ has been defined to mean any entity formed, registered or incorporated outside India (including in IFSC) that has ‘limited liability’. The introduction of ‘limited liability’ concept is a welcome move as it removes ambiguity regarding the eligible entities in which overseas investment can be made. ‘Limited liability’, as defined in the OI Directions, has been given to mean a structure where the liability of the person resident in India is clear and limited. Accordingly, it is now clear that investment in foreign limited partnerships / LLCs should be permitted whereas investment in sole proprietorships or general partnerships where liability is unlimited will not be permitted.

The OI Directions have also specified that in case of a foreign entity being an investment fund or vehicle, set up as a trust and regulated by the financial services regulator in the host jurisdiction, the liability of the person resident in India should be clear and limited and should not exceed their interest or contribution in the fund in any manner. Further, the trustee of such investment fund should be a person resident outside India.

However, the restriction of limited liability is not applicable to an entity with core activity in a ‘strategic sector’ (refer discussion on strategic sector below). The OI Directions further clarify that ODI can be made in strategic sectors in unincorporated entities as well.

Net Worth: The vague definition of net worth under the ODI Regulations was paid up capital and free reserves. The definition did not specify the treatment for losses, deferred expenditure etc. Under the OI Rules the definition of net worth has been aligned with the definition provided under the Companies Act, 2013. The OI Rules also clarify the manner of determination of net worth for partnerships and LLPs. Clarity has now been provided with respect to reduction of accumulated losses while computing net worth.

Overseas Direct Investment (“ODI”) and Overseas Portfolio Investment (“OPI”): ODI means (i) acquisition of any unlisted equity capital or subscription as a part of the Memorandum of Association of a foreign entity, or (ii) investment in 10% or more of the paid-up equity capital of a listed foreign entity, or (iii) Investment of less than 10% in equity capital, but with control, of listed foreign entity. Further, OPI has been defined to mean investment, other than ODI, in foreign securities. OPI does not include investment in any unlisted debt instruments or any security issued by a person resident in India (other than those located in an International Financial Service Centre (“IFSC”) within in India).

Erstwhile Regime: The term ‘direct investment outside India’ under the ODI Regulations carved out ‘portfolio investment’ from its ambit. However, the term portfolio investment was not defined under the ODI Regulations. Further, under the ODI Regulations, investment outside India, both by individuals and non-individuals was permitted in a wholly owned subsidiary (“WOS”) or joint venture (“JV”).

Current regime: At theoutset, the OI Rules have revamped the meaning of ODI and has removed the concept of investment in a WOS / JV to investment in foreign entity. Further, a definition of OPI has been included to cover investments which do not qualify as ODI. Thus, the following investments should be covered under ODI:

- Investment in even a single share of an unlisted foreign entity;

- Subscription to memorandum of association of foreign entity;

- Investment of 10% or more in equity capital of listed foreign equity;

- Investment with control of less than 10% in equity capital of listed foreign equity.

As a corollary, OPI should include investment of less than 10% in equity capital of listed foreign entity without control. The OI Directions clarify that OPI shall not be made inter-alia in unlisted debt instruments, any derivatives unless permitted by RBI.

Strategic sector: The OI Rules introduces the concept of ‘strategic sector’ to enable greater Indian investment in such sectors abroad. Strategic sector has been defined in an inclusive manner to include energy and natural resources sectors such as oil, gas etc. and startups. However, the OI Rules or OI Directions do not provide any guidance on the meaning of ‘startups’ for purpose of strategic sector. The Central Government also has the power to notify any other sectors as strategic sectors as it may consider necessary.

Subsidiary / Step down subsidiary (“SDS”): The OI Rules link the determination of subsidiary or SDS of a foreign entity to control. In this regard, subsidiary or SDS has been defined to mean an entity in which the foreign entity has ‘control’. It is further provided that the structure of such subsidiary/SDS shall comply with the structural requirements of a foreign entity i.e. such subsidiary/SDS shall also have limited liability where the foreign entity’s core activity is not in strategic sector. Accordingly, the investee entities of the foreign entity where such foreign entity does not have control shall not be treated as SDSs and therefore, is not required to be reported under OI Rules.

III. OVERSEAS INVESTMENT

Automatic Route

Rule 9 lays down the general rule for overseas investments under the automatic route. It states that subject to prescribed limits and conditions, any overseas investment by a person resident in India shall be made in a foreign entity7 engaged in bona-fide business activity, directly or through step-down subsidiary or the special-purpose vehicle.

Step-down subsidiary, in respect of a foreign entity, has been defined as an entity in which the foreign entity has control.8 It is also provided that for investments made through a step-down subsidiary to qualify as overseas investment and be permissible under these OI Rules, the step-down subsidiary shall comply with the structural requirements of a foreign entity, i.e. it shall have limited liability. Earlier, overseas direct investments (ODI) was only allowed in an entity engaged in bona-fide business activity either directly, or through one layer of SPV. In this context, the new Rule seems to be expansive in as much as it allows overseas investment into an entity engaged in bona-fide business, including through multiple layers of step-down subsidiary or special purpose vehicle. In other words, it may now be possible to invest in a foreign holding company (SPV) which has one of more layers of foreign subsidiaries as long as the ultimate foreign subsidiary is engaged in a bona fide business activity.

‘Bona-fide business activity’ has been defined as any business activity permissible under any law in force in India and the host country / host jurisdiction. Hence, the business activity must be permitted under the laws of India as well as the host country for it to qualify as ‘bona-fide’ business activity.

The definition of the term bona-fide business activity is a welcome move as it brings about a certain level of clarity. Having said that, confusion still prevails in terms of what is meant by permitted under laws of India (and also the laws of the host country). There may be activities, such as gambling, which are state subjects and may be permitted in some states whilst not being permitted in others. Additionally, whether a pure holding company will qualify as a bona-fide business activity also remains a question due to the manner in which the definition has been worded.

Further, keeping in mind that control is defined to mean the right to appoint majority of the directors or control the management or policy decisions, and ODI means the acquisition of unlisted equity capital, subscription to MoA of a foreign entity, investment in 10% or more of listed securities, or investment in less than 10% of listed securities with control, it may be possible to argue that control is possible without infusion of capital. Accordingly, where a foreign entity is set up without any outward remittance of cash (for example in Delaware where a company can be incorporated without capital contribution), and the Indian resident has control of such entity, the transaction should qualify as an ODI. Similarly, a gift of controlling shares of a foreign entity from a non-resident to resident may also result in the resident having made ODI into the foreign entity.

Approval Route

Rule 9 also provides that overseas investment under the automatic route, shall not be made into a company incorporated in Pakistan (including by way of swap of securities) or such other country as may be decided by the Central Government, from time to time.

The OI Rules read with the OI Directions provide that:

- Approval from Central Government: the applications for overseas investments (including financial commitment) in Pakistan / other countries as may be restricted by the Central Government from time to time or in strategic sectors / specific geographies beyond the prescribed limits, shall be made to the Central Government through the RBI. As such, the applications shall be forwarded by the AD banks to the RBI for onward submission to the Central Government.

- Approval from Reserve Bank: As set out under the Erstwhile Regime, the OI Rules also provide that financial commitment by an Indian entity, exceeding USD 1 billion (or its equivalent) in a financial year shall require prior approval from the RBI even when the total financial commitment of the Indian entity is within the eligible limit.

In essence, the Rule provides that approval with respect to investment in restricted geography / sector has to be obtained from the Central Government, whereas approval for investments beyond the monetary limit has to be obtained from the RBI.

IV. NO OBJECTION CERTIFICATE

Rule 10 provides that if any person resident in India who – (i) has an account appearing as a non-performing asset (NPA); or (ii) is classified as a willful defaulter by any bank; or (iii) is under investigation by a financial services regulator or by investigative agencies in India such as the Central Bureau of Investigation (CBI), Directorate of Enforcement (“ED”) or Serious Frauds Investigation Office (“SFIO”) – shall obtain a No Objection Certificate (NOC) from the concerned bank, regulator or investigative agency, as the case may be, for making any financial commitment or undertaking any divestment under the OI Rules. Given that this requirement is only for financial commitment, it seems to not be applicable for making OPI investments.

It is provided that if the bank, regulator or investigative authority, as the case may be, fails to furnish the NOC within 60 days from the receipt of application, an NOC may be presumed to have been obtained.

Further, the OI Directions clarify that where an Indian entity has already issued a guarantee in accordance with the OI Rules before an investigation has begun or account is classified as an NPA/ willful defaulter and is subsequently required to honour such guarantee, such remittance will not constitute fresh financial commitment and hence NOC shall not be required.

V. TRANSFER OR LIQUIDATION

Rule 17 provides that a person resident in India holding equity capital in a foreign entity in accordance with these OI Rules may transfer such investment, in compliance with limits and conditions for such investment / divestment, pricing guidelines or documentation and reporting requirements, in the manner provided under the OI Rules and OI Regulations.

It specifically provides that a person resident in India may transfer equity capital of a foreign entity by way of a sale – either to a person resident in India who is eligible to make such investments under the OI Rules or, to a person resident outside India.

It states that if the transfer is on account of merger, amalgamation, demerger or on account of buy-back of foreign securities, such transfer shall have the approval of the competent authority as per the applicable laws in India or the laws of the host country, as the case maybe. This seems to indicate that the OI Rules require prior approval when transfer is to take place not by sale, but by way of operation of law (i.e. in scenarios such as by way of merger, demerger etc.). Even if that be the case, there is no clarity on who will be the competent authority and what factors govern whether the approval needs to be taken as per the laws in India or the laws of the host country. The OI Rules require such approval from the competent authority even in case of liquidation of overseas investment by virtue of liquidation of the foreign entity.

Rule 17 further provides that where the disinvestment by a person resident in India pertains to ODI – (i) the transferor, in case of full divestment (other than by way of liquidation), shall not have any outstanding dues to be received from the foreign entity; (ii) the transferor, in case of any divestment must have stayed invested for at least one year from the date of making the ODI. The first condition seeks to ensure that monies that are due to come to India, come to India before a person resident in India exits from a foreign entity. Importantly, the OI Directions clarify that the first condition shall not apply to dues that do not arise on account of investment in equity or debt, i.e. current account payments such as export receivables etc. It seems that the second condition seeks to ensure that ODI’s are genuine and not made as part of any aggressive structuring to circumvent India’s foreign exchange laws.

It is provided that the abovementioned conditions shall not apply in case of transfer by way of merger, demerger between two or more foreign entities that are wholly owned, directly or indirectly, by the Indian entity9 or where there is no change or dilution in aggregate equity holding of the Indian entity in the merged, demerged or amalgamated entity. It seems that such a relaxation has been provided for overseas investments made only by Indian entities, and not individuals.

Lastly Rule 17 provides that the holding of any overseas investment or transfer in relation to such investment shall not be permitted if the initial investment was not permitted under the Foreign Exchange Management Act, 1999, to begin with.

VI. PRICING GUIDELINES

The pricing guidelines are now more rationalized and simplified. Under the Erstwhile Regime, the valuation report was required either from a Category I Merchant Banker registered with SEBI or by a chartered accountant based on size and nature of investment. Now, under Rule 16, the issue or transfer of equity capital of a foreign entity from a person resident outside India or a person resident in India to a person resident in India or from a person resident in India to a person resident outside India is subject to a price arrived on an arm’s length basis as per any internationally accepted pricing methodology and such valuation report can be issued by any recognized valuer. In case of ODI transactions involving deferred payments, it is clarified that the full consideration (i.e. including deferred consideration) eventually paid should be subject to the arm’s length value up front.

The onus has been now put on the AD bank to ensure compliance with an arm’s length pricing as per any internationally accepted pricing methodology and the AD banks are required to frame their board approved policy in this regard. While this move offers operational flexibility to the AD banks, it could result in divergent practices amongst the banks unless the RBI specifies some guiding principles such as ‘arm’s length pricing’ determination. Specifically, the RBI may need to clarify whether the transaction must be done exactly at arm’s length or whether higher consideration may also be paid.

VII. TRANSFER AND DISINVESTMENT OF OVERSEAS INVESTMENTS

Under the Erstwhile Regime, there were several conditionalities imposed in relation to transfer and disinvestment of overseas direct investments. Disinvestment involving write-off was allowed under automatic route only in a few cases based on the listing status of overseas JV/WOS or of the Indian party and having a prescribed net worth and subject to a prescribed investment size in the JV/WOS. In the current regime, all such conditions are significantly relaxed including removal of restriction on write-off of investments provided that, such write-off is made in accordance with the pricing and reporting guidelines. The disinvestment involving write-off is now permitted under the automatic route. This is expected to make the disinvestment process much faster and smoother.

The restriction on any disinvestment in case of dues outstanding from the foreign entity other than in connection with equity capital or debt investment (such as technical know-how fees, royalty, consultancy, export proceeds etc.) is relaxed now. Now, the repatriation of only the dues that arise on account of equity or debt investment is a pre-condition for the full disinvestment and in case of partial disinvestment, this condition does not apply at all. While the transferor continues to have to stay invested for at least one year under new regime, the earlier requirement of filing Annual Performance Report (APR) for at least one year to be eligible for making disinvestment has been done away with. Further, the person under investigation by CBI/DoE/SEBI /IRDA or any other regulatory authority in India who was earlier restricted is now permitted to make disinvestment after obtaining no-objection certificate from such agency/authority. All these relaxations are significant and are indicative of easing of business processes by the Government.

VIII. RESTRUCTURING

Under Rule 18 of the OI Rules, a person resident in India who has made ODI in a foreign entity can permit restructuring of the balance sheet by a foreign entity, which has been incurring losses for the previous two years as per its last audited balance sheets, subject to ensuring compliance with reporting, documentation requirements and subject to the diminution in the total value of the outstanding dues towards such person resident in India on account of investment in equity and debt, after such restructuring not exceeding the proportionate amount of the accumulated losses.

The diminution in value is required to be certified on an arm’s length basis by a registered valuer as per the Companies Act, 2013 / an equivalent party registered or certified public accountant in the host country, where – (a) where the amount of original investment is more than USD 10 million; or (b) where the amount of diminution exceeds 20% of the total value of the outstanding dues towards the Indian entity. The certificate dated not more than 6 months needs to be submitted to the AD bank for this purpose. It is further clarified that mere revaluation of assets in the books of the Indian entity without any restructuring of the balance sheet of the foreign entity will not qualify as restructuring. Subject to aforesaid certification of diminution in value, the Government has done away with the maximum limits prescribed for restructuring under the Erstwhile Regime.

IX. COMPLIANCE/REPORTING NORMS

Upon successful implementation of late submission fee (LSF) for foreign direct investments filings, the Government has introduced LSF concept also to the overseas investments. This applies to delay in filing any form or return under the OI Rule or OI Regulations and works as an option for regularising reporting delays without undergoing the compounding process. Prior to this, for such reporting lapses, the law only provided for adjudication process, or the party in default had only the option to undergo a cumbersome compounding process. Now, there is an opportunity to regularise such filing lapses by paying the applicable LSF within 3 years from the reporting due date, without having to undergo the compounding process. Besides the future reporting delays, LSF facility has also been extended to delays in reporting under the Erstwhile Regime for 3 years from the date of notification of OI Rule and OI Regulations.

There have been reforms to the forms that are to be filed and other relaxations in conditions including for compliances.

While the aforesaid reforms support the ease of reporting compliances, the new rules also ensure strict monitoring of compliances by expressly restricting any further ODI investment till the time any delay in reporting is regularised.

X. RESTRICTED ACTIVITIES

Rule 19(1) of the OI Rules restrict a person resident in India from making ODI in a foreign entity engaged in (i) real estate activity10; (ii) gambling; and (iii) dealing with financial products linked to the Indian rupee11 without RBI’s specific approval.

Interestingly, the Government has now removed the restriction on ODI in banking business which provides an opportunity to the Indian banks to expand their operations outside India by either setting up wholly-owned subsidiaries or entering into joint ventures with the foreign banks.

ODI in Offshore Start-ups

Rule 19(2) of the OI Rules permits ODI in start-ups recognised under the laws of the host country or host jurisdiction, as the case may be, provided that the offshore investment by an Indian entity should only be from its / group’s / any associate company’s internal accruals, and in case of a resident individual, the investment should be from its own funds.

While this aims to ensure the creditworthiness of the investee start-up, the non-provision of the meaning of ‘recognised’ under the OI Rules may result in uncertainty considering that a host country / jurisdiction may not have a recognition / registration system in place for start-ups.

The restriction of use of leverage / borrowing by Indian entities and individuals for investments seems to be a step taken considering that investments in start-ups could be comparatively riskier and volatile with no guaranteed returns. If such is the case, the efficacy of such measure should largely depend upon the way a ‘start-up’ is defined in the host country / jurisdiction.

Round Tripping

Under the Erstwhile Regime, the RBI did not define ‘round tripping’ as such; however, the essence was captured in the response to FAQ 64 of the ODI FAQs which neither permitted an Indian party to set up Indian subsidiary(ies) through its foreign WOS / JV, nor allowed an Indian party to acquire a WOS or invest in a JV that already had direct / indirect investment in India under the automatic route.

The said prohibition on round tripping structures and the uncertainty on whether such transactions would receive RBI’s blessings, have been, to an extent, done away with by the OI Rules. Rule 19(3) of the OI Rules permit a round tripping structure, provided that such structure is limited to having two layers of subsidiaries.

While such structures are now liberalised, it is still not entirely clear whether the ‘two layers of subsidiaries’ needs to be considered from the perspective of Indian party or the foreign entity. Further, whether or not the entity resulting in round tripping into India needs to be considered while calculating the two layers of subsidiaries is unclear. If this restriction is intended to be applied only on the number of layers maintained outside India and not the entity in India itself which results in round tripping, then the Indian party may be allowed to have two layers of investments (i.e. foreign entity and one of its step down subsidiary outside India) before investing back in India and such structures will not require the RBI’s specific approval now.

Further, based on the definition of subsidiary which is limited to a subsidiary of a foreign entity it may also be possible argue that a structure where the Indian party invests in an foreign entity is allowed to have two layers of further investments, in which case the structure will have three foreign entities, but only two layers of subsidiaries (i.e. foreign entity, its step down subsidiary, followed by another step down subsidiary, all outside India) before investing back in India and such structures will not require the RBI’s specific approval now.

Despite the ambiguity, this relaxation by the Government can be seen as a long-awaited welcome change, since now Indian businesses can expand globally and downstream their revenues to an Indian subsidiary increasing the depleting forex reserves.

Further, this would also help the offshore businesses having reservations on account of legal, regulatory and tax reasons to establish a joint venture in India with the Indian businesses, since now, an Indian and an offshore entity can establish a joint venture in a mutually agreeable overseas jurisdiction to make investments into India.

XI. ACQUISITION AND TRANSFER OF IMMOVABLE PROPERTY OUTSIDE INDIA

Under rule 21 of the OI Rules, a person resident in India cannot acquire or transfer any immovable property situated outside India without general or special permission of RBI, except for in the following situations:

- Property held by a person resident in India who is a foreign national.

- Property acquired by a person resident in India on or before July 8, 1947 and is continued to be held by such person with the permission of the RBI;

- Property acquired by a person resident in India on a lease of less than 5 years.

Additionally, general permission has been given by the Government to acquire / transfer immovable property outside India in the following cases:

- Acquisition from person resident in India – Property can be acquired by way of gift, inheritance or purchased from a person resident in India provided that such property has been acquired as per foreign exchange laws prevailing at the time of such acquisition;

- Acquisition from person resident outside India – Property can be acquired from a person resident outside by way of:

- inheritance;

- purchase out of foreign exchange held in RFC account;

- purchase out of LRS remittances;

- jointly with a relative12 who is a person resident outside India;13 and

- out of income or sale proceeds of the assets, other than ODI, acquired overseas in accordance with FEMA.

- Acquisition by an Indian Entity14 with an overseas office – A property situated outside India can be acquired by an Indian Entity with an overseas office in order to fulfil business and residential purposes of its staff, subject to limits prescribed under the OI Directions for total remittances for initial and recurring expenses.

Lastly, the OI Rules permit transfer of property by way of gift to an eligible person resident in India or by way of sale. Further, a person resident in India who has acquired the property can also create charge on such property in accordance with the applicable laws.

XII. ODI BY INDIAN ENTITIES

An Indian Entity may make ODI by way of investment in equity capital for the purpose of undertaking ‘bonafide business activity’ in the manner prescribed under the OI Rules inter-alia including purchase of equity capital, acquisition of equity capital by way of rights issue or allotment of bonus shares, swap of securities, capitalization of amounts due towards Indian entity etc.

The Erstwhile Regime permitted funding of overseas investment by way of swap of ‘shares’.15 This limited swap transactions to situations wherein Indian Entity making overseas investment had to necessarily issue further shares in exchange of shares of foreign entity. The OI Rules provide Indian Entities the flexibility to make ODI by way of swap of securities i.e. Indian Entity may issue or receive instruments other than shares for making such ODI.

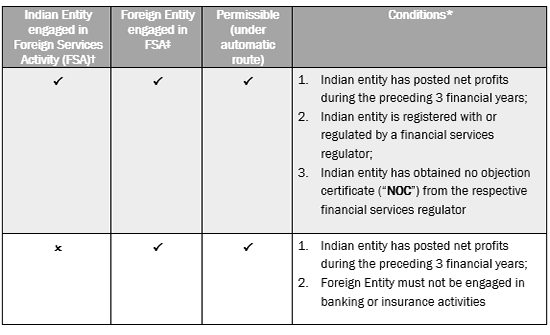

ODI in financial services sector

The OI Rules provide flexibility for Indian Entity regulated by a financial services regulator to make ODI under the automatic route. This is a welcomed changed as under the erstwhile ODI Regulations only Indian entities registered with the relevant regulatory authority were permitted to make ODI under approval route. Accordingly, Indian Entities, like managers of SEBI registered AIFs who are not registered but only regulated by SEBI, were required to apply to RBI for an approval for making ODI. Now, these managers are permitted to set up foreign managers or funds under the automatic route, subject to the conditions set out below.

Another significant change introduced in the OI Rules is the ability for Indian Entities not engaged in financial services to invest in a foreign entity engaged in financial services. Under the Erstwhile Regime, such Indian entities had to first obtain a registration (eg. as a portfolio manager) with a regulatory authority in India before setting up a foreign entity. The flexibility now provided increases the ability of Indian companies to take exposure in financial services entities outside India by merely satisfying the net profit criteria

We have summarized the manner of making ODI in financial services sector in the table below:

Limit for financial commitment

Similar to the Erstwhile Regime, the aggregate financial commitment made by an Indian entity in all the foreign entities has been capped at 400% of the net worth as on the date of the last audited balance sheet or as directed by the RBI, in consultation with the Government. It has further been clarified that the financial commitment would not include capitalization of retained earnings but include amount raised by the issuance of depository receipts (“DRs”), stock-swap of DRs and ECB proceeds.

It is to be noted that the OI Directions have done away with utilizing net worth of the subsidiary / holding company. Moreover, the definition of ‘net worth’ has been pegged to the Companies Act, 2013 which limits its scope when compared to the Erstwhile Regime where it was broader and defined to mean the aggregate value of the paid up capital and free reserves.

XIII. OPI BY AN INDIAN ENTITY

Schedule II of the OI Rules permits an Indian entity to make portfolio investment up to 50% of its net worth calculated as on the date of its last audited balance sheet. Further, a listed Indian company may make OPI, including by way of reinvestment.16

Furthermore, an unlisted Indian entity is allowed to make OPI by way of rights issue or bonus shares, capitalization for realization of any amount due towards such Indian entity from the foreign entity, swap and merger / demerger / amalgamation / scheme of arrangement as per the laws of India or host country or host jurisdiction, as the case may be.

XIV. INVESTMENTS BY RESIDENT INDIVIDUALS

Overseas investment by resident individuals was governed by the Erstwhile Regime, specifically under the the ODI Regulations read with the Liberalised Remittance Scheme (“LRS”). The ODI Regulations defined ‘direct investment outside India’ to specifically exclude portfolio investments (i.e. investment of <10% without any control or management rights) from its ambit. Schedule V to the ODI regulations also provided that investment by resident individual should be made in an operating entity and no step-down subsidiary was allowed to be acquired by the JV or WOS.

Further, the permissible capital account transactions under LRS inter-alia included investment in units of venture capital funds and unlisted shares of overseas companies. The LRS did not contain any condition for investment by resident individual in an operating entity. Accordingly, a view was taken that resident individuals were permitted to invest in overseas companies and unlisted funds as portfolio investment.

Under the new regime, the OI Rules have completely overhauled the framework for overseas investment by resident individuals.

The OI Rules inter-alia permits resident individuals to make overseas investment by way of ODI in an operating foreign entity which is not engaged in financial services activity and which does not have subsidiary or step-down subsidiary where the resident individual has control in the foreign entity.

The OI Rules also permit resident individual to make ODI by way of capitalisation of amount due from foreign entity, swap of securities on account of merger, demerger, amalgamation or liquidation, acquisition of equity capital through rights issue or allotment of bonus shares, acquisition of sweat equity shares etc.

Resident individuals are permitted to make ODI in a foreign entity whether or not such foreign entity is engaged in financial services activity or has subsidiary or step down subsidiary where the resident individual has control by way of the following:

- Inheritance;

- Acquisition of sweat equity shares;

- Acquisition of minimum classification shares; or

- Acquisition of shares under ESOP

This is a major change which effectively renders avenues for making investment by resident individuals in foreign entities engaged in financial services sector very limited.

Separately, if a resident individual has acquired shares by way of (i) acquisition of sweat equity shares; (ii) acquisition of minimum classification shares; or (iii) acquisition of shares under ESOP, in each case where the individual holds less than 10% of the equity capital of such foreign company whether listed or unlisted without control will be considered to be OPI. In this context, it is interesting to note that if an individual would have acquired shares under the portfolio route under the Erstwhile Regime, such individual would not be able to make any further investment under OPI anymore. Instead investment will need to be made under a rights issue which has been considered to be ODI. Additionally, whether investment in warrants can be made or not is a question that remains answered.

Limited Partnerships Investment in Foreign Unlisted Funds

Under the Erstwhile Regime, while resident individuals were not permitted to set up JVs or WOS engaged in financial service activities under the ODI Regulations, they were permitted to make portfolio investments (ie. less than 10% shareholding without control) under LRS into unlisted shares of foreign companies set up and funds and unlisted units of foreign venture capital funds.

However, now under the OI Rules the definition of ODI includes investment in all unlisted foreign securities, irrespective of shareholding or whether such acquisition is coupled with control over the foreign entity. Accordingly, any investment made by an Indian person in the unlisted shares, units or partnership interest of an overseas fund should qualify as ODI, even if the investment results in a less than 10% shareholding of the fund without control.

The issue arises because a resident individual is not permitted to make ODI in a foreign entity which is engaged in financial services. Of course, OPI by these individuals is still permitted in entities engaged in financial services; however, OPI under the OI Rules has been restricted to only mean investment in listed securities resulting in less than 10% shareholding without control.

Accordingly, on a bare reading of the OI Rules it does not seem possible for individual Limited Partnerships (“LPs”) to make investments in foreign unlisted funds. This is a significant issue for General Partnerships (“GPs”), not only with respect to structuring of future offshore funds intended to have investments from Indian individuals, but even more significantly for existing structures which have already obtained LP commitments, which individual LPs may now not be able to fund.

This restriction also impacts certain GP carry structures which rely on the GP’s ability to make portfolio investment under LRS either into the foreign management entity or directly into the offshore fund. Typically, these GPs receive their carried interest on redemption of their shares as capital gains.

That being said, it is important to note that despite what seems like a total restriction for individuals investing in foreign unlisted entities engaged in financial services, the OI Directions provide that investments (including sponsor commitments) in units of any investment fund overseas, duly regulated by the regulator for the financial sector in the host jurisdiction, shall be considered as OPI. Therefore, it may be possible to take a view that resident individual LPs are permitted to make OPI investments (ie. less than 10% shareholding, without control) in an offshore fund, if such fund is duly regulated in its host jurisdiction17. A similar view may also be taken in the context of carry structures where GPs may be able to make OPI investment into a regulated fund; however, it may not be possible to structure such carry through the investment manager anymore.

Acquisition by way of Inheritance or Gift

The OI Rules permit a resident individual to acquire foreign securities by way of inheritance from a person who is a resident in India (who is holding such securities in consonance with the provisions of the Foreign Exchange Management Act, 1999 (“FEMA”)) or from a person resident outside India. Similarly, no limitation has been placed on resident individuals acquiring foreign securities through the mode of gift from a person who is resident in India who is a relative and is holding the securities under discussion in line with the provisions of the Act.

One of the key changes introduced by OI Rules is with respect to acquisition of foreign securities by a resident individual from a person resident outside India. In this regard, the OI Rules provide that a resident individual may acquire foreign securities from a person resident outside India in accordance with the provisions of the Foreign Contribution (Regulation) Act, 2010 (“FCRA”) and the rules and regulations made thereunder.18 FCRA regulates acceptance or utilisation of foreign contribution by certain individuals and class of persons/entities. In this regard, foreign source inter-alia includes a foreign company, foreign trust, a citizen of foreign country etc. Therefore, resident individual receiving foreign securities from a foreign source may be required to obtain FCRA registration. However, in case where foreign securities of less than INR 10 lakhs is being received by a resident individual from a citizen of a foreign country who is a relative of such resident individual, such contribution is permitted to be received without any specific approval of the Ministry of Home Affairs. In case where foreign securities of more than INR 10 lakhs are being gifted to a resident individual, the recipient is required to inform the Central Government in Form FC-1 within 3 months from the date of receipt of such contribution.

Acquisition of shares under ESOP or employee benefits scheme or sweat equity shares

The OI Rules also permit a resident individual to acquire, without limit, shares or interest under ESOP or employee benefits scheme or sweat equity shares offered by the overseas entity subject to the following:

- The resident individual is an employee or a director of (i) an office in India or a branch of an overseas entity or (ii) a subsidiary in India of an overseas entity or (iii) of an Indian entity in which the overseas entity has direct or indirect equity holding;

- The issue of ESOP or employee benefits scheme are offered by the issuing overseas entity globally on a uniform basis.

Further, ‘indirect equity holding’ has been defined to mean indirect foreign equity holding through a special purpose vehicle or step-down subsidiary. Accordingly, to fulfil the criteria in point a(iii) above, the overseas entity is required to have either (i) direct equity holding in the Indian entity, or (ii) an indirect equity holding through an SPV or subsidiary which is controlled by such overseas entity.

The Erstwhile Regime also permitted resident individuals to acquire foreign securities under ESOP. However, the OI Directions have clarified that while a resident individual is permitted to acquire foreign shares or interest under ESOP or employee benefits scheme or sweat equity shares without limit, the value of such shares / interest will count towards such individual’s LRS limit of USD 250,000. In other words, if an individual has to send USD 100,000 as grant price on exercise of the ESOPs in a financial year, they will only be permitted to remit USD 150,000 outside India under LRS.

XV. OVERSEAS INVESTMENT INTO IFSC AT GIFT CITY

An entity formed, registered or incorporated in the International Financial Services Centre at GIFT City, Gandhinagar (“IFSC”) with limited liability, including an investment fund or vehicle (as clarified in the OI Directions),19 is defined to be a foreign entity in the OI Rules (“IFSC Entity”).20

The OI Rules have generally applied the conditions for investment by persons resident in India into foreign entities (explained above under Investments by Resident Individuals), to investment by such persons in IFSC Entities as well.21 However, there are certain special provisions which apply only with respect to investment in IFSC Entities engaged in financial services activities (and do not apply to investment in other foreign entities).22 This section discusses such special provisions.

ODI into IFSC Entities

As per the general OI Rules, investment

- an Indian entity engaged in financial services activity investing in a non-IFSC foreign entity engaged in financial services needs to inter-alia obtain approvals from the financial services regulator in India as well as the regulator in the jurisdiction in which the ODI is intended to be made (“NOC”).23

- an Indian entity not engaged in financial services activity in India investing in a non-IFSC foreign entity engaged in financial services (other than banking and insurance companies) needs to have posted net profits during the preceding 3 financial years (“Profitability Criteria”).24

As per the special provisions for ODI into IFSC foreign entities, investment by:

- an Indian Entity engaged in financial services activity, if the NOC is not decided within 45 days from the date of the duly complete application for NOC, then the approval or NOC is deemed to be given; and

- an Indian Entity not engaged in financial services activity, insofar as the investee IFSC Entity is not engaging in banking or insurance activity, the Profitability Criteria is not applicable.

The time efficiencies introduced with respect to the NOC is a welcomed relief to Indian fund managers who must wait for both SEBI and IFSCA NOCs before remitting funds to their IFSC manager entity. Specifically, in the context of SEBI, these NOCs have been taking up to 4-5 months, which has caused significant delays in the capitalization of the fund manager in IFSC and subsequent launch of the fund in IFSC. This provision is also an important step towards ease of doing business in India and should help enable setting up offshore structures in the IFSC with greater speed. Further, the relaxation from the Profitability Criteria is a much awaited relief for first time GPs who often do not have pre-existing entities in India which can be used to set up the fund manager in the IFSC. This further increases the attractiveness of IFSC for Indian GPs looking to set up offshore funds as compared to foreign jurisdictions such as Mauritius or Singapore for which the Profitability Criteria must be met.

Resident individuals have also been permitted to make ODI into IFSC Entities, including those which are engaged in financial services activities (other than banking or insurance) with control only if such IFSC Entity does not have a subsidiary or a step-down subsidiary outside IFSC (in India or any other jurisdiction). This also places IFSC Entities in a better position as compared to foreign entities in other jurisdictions, because in respect of such other foreign entities, resident individuals are only permitted to make ODI in operating entities not engaged in financial services activity.

Further, an IFSC Entity which is receiving ODI from a resident individual with control is permitted to have a subsidiary or step-down subsidiary in IFSC, whereas any other foreign entity receiving ODI from a resident individual with control is not permitted to have a subsidiary or step-down subsidiary. Consequently, a resident individual who has made ODI without control may not be permitted acquire control in the IFSC entity that subsequently acquires or sets-up a subsidiary/SDS outside India.

These provisions seek to promote persons resident in India (particularly Indian GPs) to give serious consideration to IFSC as a potential jurisdiction to set up their offshore businesses. In fact, as the OI Rules now permit even those Indian entities which are not engaged in financial services to invest in foreign entities engaged in financial services (except banking or insurance), the opportunities for new structures in the IFSC has been greatly expanded. For example, a family office in India (which is an Indian entity) can now remit funds to the IFSC in order to set up a Family Investment Fund under the IFSCA (Fund Management) Regulations, 2022, and such family office would not need to meet the Profitability Criteria.

OPI into IFSC Entities

The OI Rules also permit persons resident in India to make contributions in an investment fund or vehicle set up in an IFSC as OPI.25

This route, only in respect of IFSC Entities in nature of investment funds or vehicles, covers OPI by Indian resident individuals and entities, both listed and unlisted (as has also been clarified in the OI Directions). This puts investment funds or vehicles set up in the IFSC in a more beneficial position as compared to other unlisted foreign funds because, on a bare reading of the OI Rules, Indian resident individuals should not be permitted to make such investments in the latter. Please refer to the section on LP Investment in Foreign Unlisted Funds under Part XIV – Investment for Resident Individuals.

1 https://egazette.nic.in/WriteReadData/2022/238239.pdf

2 https://egazette.nic.in/WriteReadData/2022/238242.pdf

3 https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NT110B29188F1C4624C75808B53ADE5175A88.PDF

4 https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10192

5 https://www.rbi.org.in/scripts/bs_viewcontent.aspx?Id=4024

6 https://www.rbi.org.in/scripts/bs_viewcontent.aspx?Id=4023

7 ‘Foreign entity’ has been defined as an entity formed or registered or incorporated outside India (including IFSC), that has limited liability. The restriction of limited liability does not apply to an entity with core activity in a strategic sector (which is defined separately).

8 ‘Control’ has been defined as the right to appoint majority of the directors or to control management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders’ agreements or voting agreements that entitle them to 10%. or more of voting rights or in any other manner in the entity.

9 Indian entity” means–

(i) a company defined under the Companies Act, 2013 (18 of 2013);

(ii) a body corporate incorporated by any law for the time being in force;

(iii) a Limited Liability Partnership duly formed and incorporated under the Limited Liability Partnership Act, 2008 (6 of 2009);

10 The ‘real estate activity’ has been defined as buying and selling of real estate or trading in Transferable Development Rights but does not include the development of townships, construction of residential or commercial premises, roads or bridges for selling or leasing.

11 The Directions clarify that such financial products shall include non-deliverable trades involving foreign currency-INR exchange rates, stock indices linked to Indian market, etc.

12 As defined under Section 2(77) of the Companies Act, 2013. The Erstwhile Regime, i.e. FEM (Acquisition and Transfer of Immovable Property Outside India) Regulations, 2015, defined ‘relative’ in relation to an individual to mean husband, wife, brother or sister or any lineal ascendant or descendant of such individual.

13 Under the Erstwhile Regime, it was to be ensured that when a property is being acquired jointly with a relative who is a person resident outside India, there were no outflows of funds from India.

14 Under the Erstwhile Regime, only an Indian Company having an overseas office could acquire property, however, since ‘Indian Entity’ has a wider scope now, it will include other type of legal entities as well.

15 Regulation 6 of ODI Regulations

16 ‘Reinvestment’ means that the OPI proceeds are exempted from repatriation provisions as long as such proceeds are reinvested within the time specified for realisation and repatriation as per Notification No. FEMA 9(R)/2015-RB namely, Foreign Exchange Management (Realisation, repatriation and surrender of foreign exchange) Regulations, 2015.

17 It is relevant to note that the financial services regulator in most jurisdictions regulate the fund manager and not the fund itself (eg. Singapore, Mauritius, etc.). It is only in certain jurisdictions like the Cayman Islands and Delaware where it may be possible argue that the fund itself is regulated.

18 Pertinent to note that under the Erstwhile RegimeRRegulations a general permission had been provided to a resident individual to acquire foreign securities by way of gift from a person resident outside India.

19 (1)(i) of Part I of Annex-I of the Foreign Exchange Management (Overseas Investment) Directions, 2022

20 Rule 2(1)(h) of the OI Rules

21 Para 1(2), Schedule V, OI Rules

22 Rule 15 and Schedule V, OI Rules

23 Para 2(1)(iii) of Schedule I, OI Rules

24 Para 2(2) of Schedule I, OI Rules

25 Para 1(2)(iii), Schedule V, OI Rules

Chambers and Partners Asia-Pacific: Band 1 for Employment, Lifesciences, Tax and TMT, 2022

AsiaLaw Asia-Pacific Guide 2022: Ranked ‘Outstanding’ for Media & Entertainment, Technology & Communications, Labor & Employment, Regulatory, Private Equity, Tax

Who’s Who Legal: Thought Leaders India 2022: Nishith M Desai (Corporate Tax – Advisory, Corporate Tax – Controversy and Private Funds – Formation), Vikram Shroff (Labour & Employment and Pensions & Benefits) and Vyapak Desai (Arbitration)

Benchmark Litigation Asia-Pacific: Tier 1 for Tax, Labour and Employment, International Arbitration, Government and Regulatory, 2021

Legal500 Asia-Pacific: Tier 1 for Tax, Data Protection, Labour and Employment, Private Equity and Investment Funds, 2021

IFLR1000: Tier 1 for Private Equity and Tier 2 for Project Development: Telecommunications Networks, 2021

FT Innovative Lawyers Asia Pacific 2019 Awards: NDA ranked 2nd in the Most Innovative Law Firm category (Asia-Pacific Headquartered)

RSG-Financial Times: India’s Most Innovative Law Firm 2019, 2017, 2016, 2015, 2014

DISCLAIMER

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.