Tax Hotline: AAR applies the ‘Look Through’ approach – denies treaty relief to a Mauritian entity on transfer of Indian shares

Posted by By nishithadmin at 12 March, at 12 : 08 PM Print

Warning: count(): Parameter must be an array or an object that implements Countable in /web/qlc/nishith.tv/htdocs/wp-content/themes/Video/single_blog.php on line 46

Warning: count(): Parameter must be an array or an object that implements Countable in /web/qlc/nishith.tv/htdocs/wp-content/themes/Video/single_blog.php on line 52

AAR APPLIES THE ‘LOOK THROUGH’ APPROACH – DENIES TREATY RELIEF TO A MAURITIAN ENTITY ON TRANSFER OF INDIAN SHARES

- AAR disallows treaty relief on capital gains tax to a Mauritian resident on transfer of Indian shares, on the basis that it was not the beneficial owner of the shares transferred.

- Holds that setting up of a Mauritian entity immediately prior to investment into India indicates that the dominant purpose of setting up the structure was tax avoidance.

- Holds that the Mauritian SPV had no substance or commercial purpose on the basis that it did not have any financial background for the investment, tangible business assets, employees or office space.

Recently, the Mumbai bench of the Authority for Advance Rulings (“AAR”) passed an order rejecting capital gains tax benefit under Article 13(4) of the India – Mauritius Double Taxation Avoidance Agreement (“India – Mauritius DTAA”) to a Mauritian entity, i.e. Bid Services Division (Mauritius) Limited (“BSDM / Applicant”) – part of a global consortium on sale of shares of an Indian joint venture (JV) namely, Mumbai International Airport Limited (“MIAL”) for development of the Mumbai airport. Treaty relief was denied on the basis that BSDM was a mere conduit / shell entity and hence was not the beneficial owner of the shares transferred.

FACTS

The Applicant is a wholly owned subsidiary of Bid Services Division (Proprietary) Limited, a company incorporated in South Africa (“BSDPL”), which in turn is a wholly owned subsidiary of another South African company, namely Bidvest Group Limited (“Bidvest”) – together referred to as the (“Bidvest Group”). The Applicant holds a Category 1 Global Business License (“GBL 1”) and a valid Tax Residency Certificate (“TRC”) issued by the relevant authorities in Mauritius. Further, the Applicant files its corporate tax returns in Mauritius, conducts board meetings in Mauritius and hence the effective control and management of the Applicant is situated outside India, i.e. in Mauritius. Moreover, the Applicant does not have any permanent establishment / business connection in India.

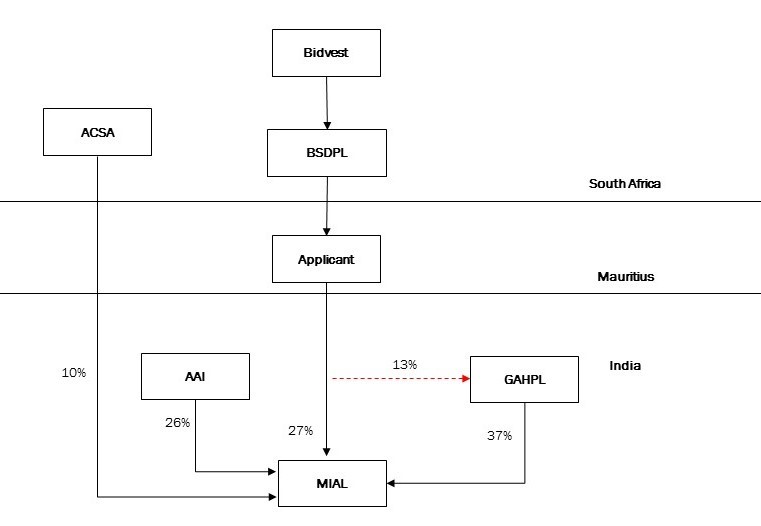

The Airports Authority of India (“AAI”), which held 26% of the shares in MIAL, called for a bid for the remaining 74% for the purposes of undertaking development, operation and maintenance activities at the Chhatrapati Shivaji International Airport in Mumbai (“Project”). Among the bids submitted, the AAI selected the bid submitted by the GVK – SA consortium (“Consortium”). The Applicant was one of the entities in the Consortium which invested in MIAL. The Applicant, being one of the entities of Consortium, subscribed to 27% of the shares of MIAL in a phased manner between 2006 and 2010. In 2011, the Applicant sold 13.5% of its shareholding in MIAL to GVK Airport Holdings Private Limited (“GAHPL”), an already existing shareholder of MIAL from within the Consortium. A diagrammatic representation of the structure and transaction is as below:

ARGUMENTS BY THE REVENUE

- The Revenue argued that the bidding process involved two long drawn stages, but the Applicant was set up as a subsidiary of BSDPL to invest into MIAL only at the end of the bidding process. Revenue also submitted that even if the Bidvest Group wanted to undertake an SPV to undertake the Project, Mumbai or South Africa would have been the optimal choice and Mauritius was chosen merely for the purposes of availing treaty relief. The Applicant in Mauritius lacked commercial substance and bona-fide business purpose and was set up as a device to avoid Indian taxes.

- Section 93 of the ITA provides that transfer of Indian assets which results in a non-resident acquiring rights to enjoy the income earned by the transferor shall be deemed to be income of that non-resident and taxed in India. Revenue argued that the transfer of shares of MIAL by the Applicant resulted in Bidvest, a non-resident company, acquiring the right to enjoy the capital gains earned by Applicant on the Transfer, and hence, section 93 was applicable, resulting in the income arising from the Transfer being deemed to be income in the hands of Bidvest.

- The Applicant failed to furnish the following documents requisitioned by the Revenue through the AAR (i) copy of the Inter -se Consortium Agreement, (ii) copies of the board resolutions and financial statements pertaining to financial years 2005 to 2010.

- In cases such as Vodafone1, CIT v. Wipro Ltd.2, DIT v. Copal Research3, CIT v. Panipat Woolen and General Mills Co. Ltd.4 [1976] 103 ITR 66, principles of ‘substance over form’, ‘piercing the corporate veil’ etc. have evolved for the purpose of determining whether a transaction is sham or tax avoidant. Reliance was also be placed on the recent ruling of the AAR in Seedworks Holdings Mauritius, In re5 wherein the interposed Mauritian entity was overlooked and the transaction was held to be taxable in India.

ARGUMENTS BY THE APPLICANT

- The Applicant argued that capital gains arising from the Transfer shall not be taxable in India in accordance with Article 13(4) of the India – Mauritius DTAA, which provides that such sale of shares of an Indian company shall be taxable only in the resident state. In this regard, the Applicant relied on Circular 682 and Circular 789 issued by the Central Board of Direct Taxes (“CBDT”) and a variety of judgments such as Union of India v. Azadi Bachao Andolan6, E Trade Mauritius Ltd7., DB Zwirn Mauritius Trading8, Ardex Investments Mauritius Ltd9. and Vodafone International Holdings B.V. v. Union of India10 where transfer of Indian shares by Mauritian residents were held to be exempt from capital gains under the India – Mauritius DTAA and TRC was considered as conclusive proof of ‘residence’ and ‘beneficial ownership’ for the purposes of availing treaty benefits.

- Regarding the argument of the Revenue on non-inclusion of the Applicant in the initial stages of the bidding process, the Applicant stated that in the Expression of Interest (“EOI”) submitted in the first stage, it was clarified that the final shareholding of the Consortium would be finalized once the requirements for the request for proposal were known, and that the name of the Applicant as a shareholder was then furnished towards the end of the bidding process.

- It is general practice for MNCs to be the face of a bid to establish competency and for the eventual investment to be made by an SPV formed for commercial reasons such as hedging of risks, mobility of investments, ability to raise loans etc. Mauritius is an ideal destination for investments in Asian markets and it is common global practice to route investments into the Asian markets through Mauritius.

- Section 93 should not apply to the Transfer. This is because the intention of introducing the said provision was to tax income arising out of transactions which ‘residents’ undertake to externalize assets, while continuing to enjoy the rights over such assets and the income therefrom – which was not the case in the present scenario as the Transfer was not undertaken by a ‘resident’.

- Regarding the claim that the Applicant was set up immediately prior to the investment in MIAL, the Applicant argued that the investment was made for modernization of the Mumbai Airport and was made over a period of 7 years based on periodic calls made by MIAL. Further, the Applicant sold the shares after holding them for 5.5 years and it continued to carry on operations pursuant to partial divestment of 13.5% of the shares (out of 27%).

- Even if it is assumed without admitting that the transaction was undertaken only to obtain tax benefit, it was argued that treaty benefit cannot be denied in the absence of a limitation of benefits (LOB) clause in the India – Mauritius DTAA.

RULING

The AAR ruled that the Applicant was not entitled to avail capital gains tax benefit under Article 13(4) of the India – Mauritius DTAA. The primary reason for disallowing treaty benefit was the interposing of the Applicant in Mauritius at the end of the bidding process, without any economic and commercial rationale. Additionally, the AAR held that the Mauritius entity was a shell / conduit entity with no assets, employees, office space. Further, based on the nature of the Project, there was no commercial reason to set up the SPV in Mauritius, given that it earned no reputation as a financial hub or a seat of civil aviation experts. Regarding the argument of the Applicant that even if the transaction was designed only to obtain tax benefit, the same cannot be denied in the absence of an LOB clause, the AAR held that it has been recognized in Vodafone 11 that if it is established that a Mauritian company is interposed as a device, it is open for the tax department to discard the device and take into account the real transaction, even in the absence of an LOB. Considering that it anyway denied benefits under the India – Mauritius DTAA to the Applicant on the basis that it was not the beneficial owner of the shares transferred, the AAR did not consider it important to discuss the other urgings of the Revenue, i.e. the applicability of section 93, non-supply of certain documents by the Applicant and the valuation of the shares of MIAL etc.

ANALYSIS

This ruling has come as a reminder that even for the grandfathered investments (investments made prior to April 1, 2017) treaty relief under the India – Mauritius DTAA may not be allowed on the mere production of the TRC, and that a case by case analysis may be needed. While this seems to be the recent judicial trend, the approach appears to be erroneous. Further, this ruling seems to have particularly erred in several aspects, as discussed below.

It seems that the primary reason for disallowing treaty benefit in the present case was the interposing of the Applicant in Mauritius at the end of the bidding process. Firstly, as is clear from the facts, the Applicant acquired its total shareholding in MIAL over a period of 7 years. Secondly, the ‘timing test’, for the purposes of determining beneficial ownership requires looking at the period of time for which the shares were held prior to transfer, and not the timing of the investment itself. In this case, the Applicant held the shares for 5.5 years prior to the Transfer. Reliance in this regard may be placed on the Bombay High Court’s ruling in JSH Mauritius Limited12 where the key factor on the basis of which treaty relief was allowed was that the shares were held for 13 years prior to transfer. Thirdly, it is very common for SPVs to be set up immediately prior to investment, primarily because the SPV is set up for that purpose alone. Hence, for all these reasons, the disallowing of treaty relief on the basis that the Applicant was interposed immediately prior to investment is abhorrent.

Regarding the question on ‘substance’, the ruling has ignored aspects such as the Applicant having valid residency documents such as the GBL and TRC, it having its effective control and management in Mauritius on the basis that it filed its corporate tax returns and conducted board meetings in Mauritius. Instead the ruling has concluded that the Applicant had no substance on the basis it had no employees, assets or office space. In this regard, it shall be noted that the question of ‘substance’ should be evaluated from the perspective of the purpose of the entity. In the present case, the Applicant was an investment holding company, which typically does not require employees, assets or office spaces. The conduct of the entity for the entire holding period has not been considered and the mere fact that the Applicant was interposed prior to it making the investment has been considered as the primary basis to deny treaty relief. In fact, capital gains arises at the time of sale of the shares of the Indian company and the mere fact that the Applicant has been considered by its parent to invest into MIAL, should not render the entire holding period by the Applicant, including decision making during this period as well as for the sale of shares, redundant. While relying on the Vodafone13 ruling, the Revenue has however not considered the revalidation of holding company structures especially considering the period of time for which the shares are held by such holding companies. Further, the conclusion that there was no commercial rationale for setting up the Applicant in Mauritius on the basis that Mauritius is not a financial hub or a seat of civil aviation experts is also subject to criticism. The commercial reasons for choosing Mauritius, as substantiated by the Applicant, and as is common business practice among global conglomerates, included ring fencing of assets, ease of doing business, access of Asian markets etc. It may not be required for an investment holding company to be necessarily set up in a financial hub or in a jurisdiction which has business advantage for the ultimate investee company.

Lastly, in Seedworks Holdings14, the AAR had indicated that the denial of treaty benefits should be done sparingly and only in exceptional scenarios where the fact of tax avoidance is clear. In this case, there was nothing substantial which indicated that the transaction was a device to avoid tax and hence, the denial of treaty relief in this case, may not be received well by the international business community.

1 Supra note 3

2 [2014] 50 taxmann.com

3 [2014] 49 taxmann.com 124

4 [1976] 103 ITR 66

5 [2018] 402 ITR 311 (AAR)

6 [2003] 132 Taxmann 373 (SC)

7 [2010] 324 ITR 1 (AAR)

8 [2011] 333 ITR 32 (AAR

9 [2012] 340 ITR 272 (AAR)

10 [2012] 341 ITR 1 (SC)

11 Supra note 10

12 AAR No. 995 of 2010

13 Supra note 10

14 Supra note 5

Legal500 Asia-Pacific: Tier 1 for Tax, Investment Funds, Labour & Employment and TMT

2020, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012

Chambers and Partners Asia-Pacific: Band 1 for Employment, Lifesciences, Tax and TMT

2020, 2019, 2018, 2017, 2016, 2015

IFLR1000: Tier 1 for Private Equity and Project Development: Telecommunications Networks.

2020, 2019, 2018, 2017, 2014

AsiaLaw Asia-Pacific Guide 2020: Ranked ‘Outstanding’ for TMT, Labour & Employment, Private Equity, Regulatory and Tax

FT Innovative Lawyers Asia Pacific 2019 Awards: NDA ranked 2nd in the Most Innovative Law Firm category (Asia-Pacific Headquartered)

RSG-Financial Times: India’s Most Innovative Law Firm

2019, 2017, 2016, 2015, 2014

Benchmark Litigation Asia-Pacific: Tier 1 for Government & Regulatory and Tax

2019, 2018

Who’s Who Legal 2019:

Nishith Desai, Corporate Tax and Private Funds – Thought Leader

Vikram Shroff, HR and Employment Law- Global Thought Leader

Vaibhav Parikh, Data Practices – Thought Leader (India)

Dr. Milind Antani, Pharma & Healthcare – only Indian Lawyer to be recognized for ‘Life sciences – Regulatory,’ for 5 years consecutively

Merger Market 2018:Fastest growing M&A Law Firm in India

DISCLAIMER

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.